Hochul’s ESD Has Still Not Explained Why New Yorkers Should Give Massive Subsidies to Vornado to Finance a New Penn Station

Pennsylvania Station Area Civic and Land Use Improvement Project

On Revised General Project Plan

December 8, 2021

Good evening, my name is Rachael Fauss and I am the Senior Research Analyst for Reinvent Albany. Reinvent Albany advocates for transparent, accountable New York State government.

Today’s hearing is focused on the Penn Station General Project Plan (GPP), but we strongly urge Governor Hochul and Empire State Development Corporation (ESD) to look beyond the limited frame of the GPP and be truly transparent about who exactly will pay for this project and what assumptions ESD is making.

We again ask that the Hochul administration – which has made big claims about being transparent – provide the public with complete information so taxpayers can properly evaluate the Penn Station area project’s financing, return on investment, risks, and potential impacts on the state and city budgets. We appreciate that ESD posted additional materials on the project website this week, including from its community advisory committee (CAC) process. However, these documents are only a subset of all materials made available to the CAC.

Additionally, the GPP simply does not provide sufficient detail or evidence to support ESD’s claim that the revenue from the development is “essential” to funding Penn Station upgrades, or will be a good return on public investment for the potential massive subsidies in the form of tax abatements to Vornado, the developer.

ESD should publish on its website all analyses conducted by Ernst & Young under the $600,000 contract approved by ESD on March 26, 2020. We first asked for this basic transparency in a November 10, 2021 letter from Reinvent Albany, BetaNYC, Common Cause NY and the New York Public Interest Research Group. Our letter also asked that meeting materials from the project’s Community Advisory Committee (CAC) be published.

As of the date of my testimony, no documents credited as produced by Ernst & Young have been published online by ESD. Additionally, only limited CAC materials have been published. It was only through a Freedom of Information Law (FOIL) request that Reinvent Albany received CAC materials through June 1, 2021, all of which are published on our website. This includes a powerpoint presentation about the financing of the project from the May 25, 2021 meeting of the CAC; a different, shorter version of this has now been posted on ESD’s website. However this 19-page or 13-page PowerPoint does not credit any author. Was it produced by Ernst & Young, or ESD, or neither? Given that this presentation has no author, we question ESD’s claim to the NY Post on November 18, 2021 that the presentation was an Ernst & Young analysis presented to the CAC.

Turning to the GPP, ESD states in a July 2021 town hall presentation that the goal of the GPP is to “Establish a financial framework to generate revenue to help fund the reconstruction and expansion of Penn Station and other improvements.” However, the GPP does not show basic details or fundamental assumptions about how Vornado’s or other commercial development will generate this revenue. What occupancy rates does ESD assume? What rent per square foot? What cost per square foot? How do these assumptions square with the massive commuting changes occurring because of COVID-19 and the experience of the nearby Hudson Yards development, which has been repeatedly bailed out by the public despite very generous tax abatements?

The GPP does not answer these questions, so why is ESD so confident about gambling billions of state taxpayer dollars? What does ESD know that they have not shared? We strongly suspect the math doesn’t add up for this project and it will be a huge giveaway to Vornado under which the City government loses either existing or potential tax revenues, and state taxpayers have to bail out borrowing for the new Penn Station. That is exactly what happened just blocks away in Hudson Yards. Why should NYC miss the opportunity to undertake its own redevelopment of the area and lose other potential new tax revenues?

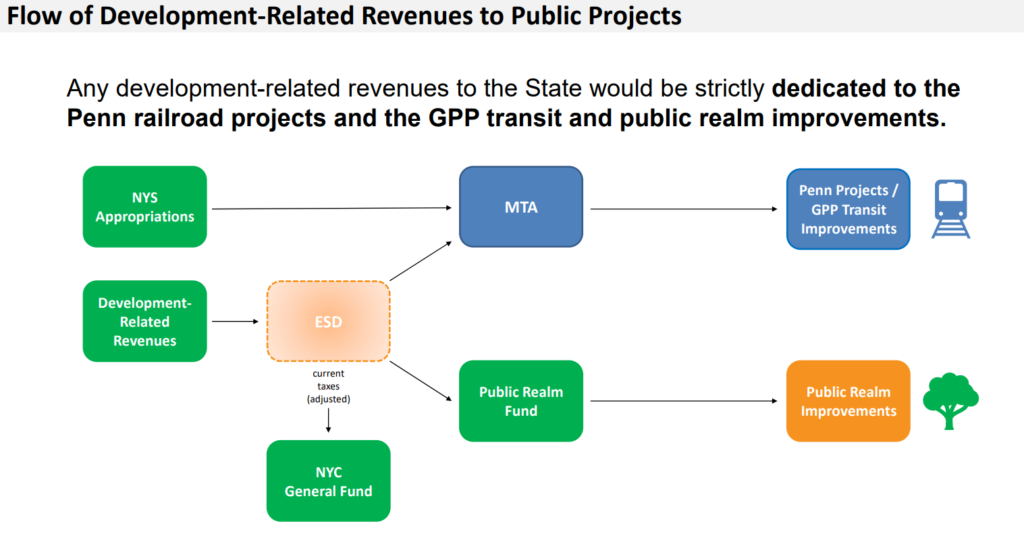

The revised GPP similarly only provides cursory information about the financial structure, with no projections of exactly how much revenue is expected to be generated from development, and how exactly much the state is expected to pay to finance the project, or could pay if the development doesn’t generate the expected revenue. The flow chart provided in the revised GPP (shown below) also does not give any specificity about how much NYC tax revenue would be retained for the NYC General Fund, or how much revenue would come to NYC to support the need for increased City services generated by the project, simply saying that current taxes would be “adjusted.”

Given these concerns, we have a number of questions that we believe should be answered before ESD and the public sign off on this project, which Governor Hochul projected would cost $5-6 billion for Penn Station upgrades alone (not the gateway expansion):

1. How much money does ESD actually project that a “value-capture” framework would provide for Penn Station upgrades? Over what period of time will revenues come in? Will this be bonded out by ESD, and what is the expected interest rate/credit rating on this type of debt?

- The GPP states that “The revenues generated by the Project will be structured in a value-capture framework to support such uses and may include PILOT, PILOST, PILOMRT, payments for development rights, and proceeds from the sale of land and/or ground lease payments as applicable.”

- This is a very broad description that does not state how much money will actually be generated by the development. Given that the Hudson Yards development project used a similar framework and the City of New York had to pick up the bill when the development failed to generate the expected revenue, there should be a public baseline about how much revenue is expected to be generated.

2. How much money does NYS expect to pay? Will NYS funds be appropriated through the NYS budget? In which budget years and/or over what period of time?

- The GPP states that “The revenues derived from the Project would allow for direct funding and/or financing mechanisms to finance the reconstruction of the existing station and the construction of the potential expanded station. These financing mechanisms may include federal grants, state appropriations, bond structures, and/or federal loan programs.” What are the specific amounts expected for federal grants, state appropriations, bond structures, and/or federal loan programs?

3. What is the worst case scenario if the development revenues do not come in as anticipated? How much could NYS taxpayers be expected to pay in a worst-case scenario if the development does not generate the anticipated revenue?

- The presentation on finances made to the CAC on May 25, 2021 does not provide specifics about how much revenue would be generated and over what period, simply saying that development would be completed in 2028. The presentation also provides this statement: “Best case scenario: a portion, but not all, of the billions of dollars necessary for New York’s share could be generated by ESC real estate by 2030, when the Penn Projects are projected to be completed.”

4. Why can’t this project go through the city’s Uniform Land Use Review Process (ULURP)? Is it only not “feasible” or “practical” because the state is choosing to supersede local zoning so that it can control the process? What is the opportunity cost to NYC for the state redeveloping the area, when a local rezoning process could have occurred?

- The GPP states that “It is not feasible or practicable to construct the Project in accordance with existing zoning or other applicable local requirements that are inconsistent with the Project. In order to construct the Project, ESD will override all provisions of the Zoning Resolution of the City of New York applicable to the eight Project Sites, together with the remaining portion of Block 783 located between Sites 4 and 5 (the “1 Penn Site”), override other local requirements applicable to such area that are inconsistent with the Project, and implement development controls and other requirements in lieu of local zoning pursuant to the UDC Act. ESD will establish design guidelines (the “Design Guidelines”) for the Project that will apply to the Project Sites in lieu of zoning and other local regulations. The private developers who would develop the buildings on all Project Sites would be required to comply with the Design Guidelines.”

5. Why is the GPP progressing ahead of the MTA’s Master Plan for Penn Station? Why aren’t both plans being considered together?

6. If ESD/the state does not intend to move MSG, per the presentation provided to the CAC and published on Reinvent Albany’s website, what is the plan for MSG’s tax abatement? Why should it continue?

MSG’s tax abatement has been in place for 38 years, and in 2020 cost the city $43 million in lost tax revenue.

7. How will the Penn Station Public Realm Fund be administered? Will the Penn Station Area Public Realm Task Force (“Task Force”) vote publicly on funding allocations? Similarly, will the ESD Board vote publicly on funding allocations from the Public Realm Fund? Will the Task Force follow the NYS Open Meetings Law?

- The Revised GPP states that a new “Penn Station Area Public Realm Fund” would be created, which would be managed by a “Penn Station Area Public Realm Task Force….The Public Realm Task Force would comprise representatives of involved State and City agencies, local elected officials, community boards, civic organizations and other stakeholders.”

- Further, “A Penn Station Area Public Realm Fund would be created and administered by ESD, with direction from the Task Force, and would be seeded by a portion of the real estate revenues generated by the GPP Sites.”

Thank you for your consideration.

The testimony is also available in PDF here.