Watchdog Testimony on MTA and Transportation Budget

Reinvent Albany advocates for transparent and accountable government. We are presenting our thoughts on the transportation components of the FY 23 Executive Budget, in particular as pertains to the MTA. Below is a summary of our positions on the proposals, findings, and recommendations from our testimony. Further analysis is detailed in the full testimony.

Operating Aid to MTA

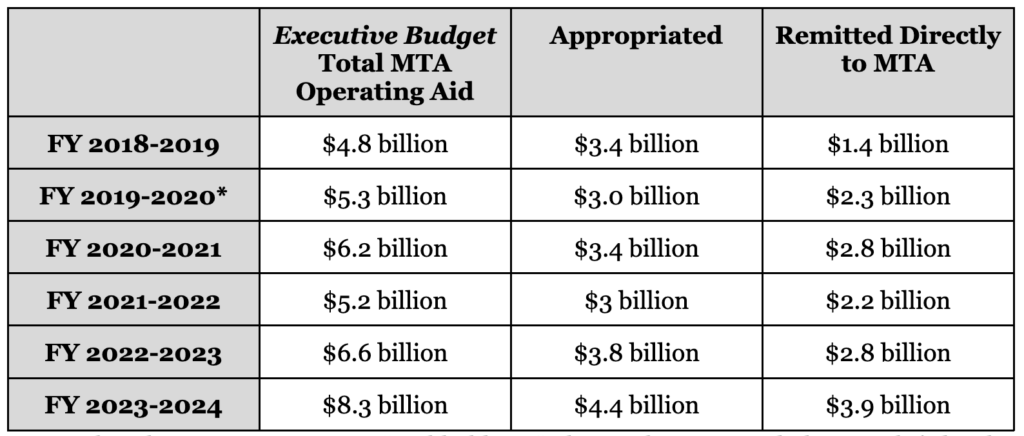

- $8.3B in total state operating aid ($4.4 billion appropriated and $3.9 billion remitted directly to the MTA) is good news for the MTA and riders, because it will keep the MTA solvent and fill budget gaps. Any new taxes and mechanisms to require local payments will be subject to intense political debate, and we urge the Legislature to examine additional funding options to ensure the MTA is fully funded in the final budget. Specifically:

- The Governor and Legislature should make good on historical funding commitments by increasing the 18-b and PMT “make whole” payments through general fund contributions instead of raiding the Metro Mass Transportation Operating Assistance fund (MMTOA), and adjusting these funds for inflation. Over the last twenty years, the State has diverted a staggering $3.8 billion of promised revenue from the MTA with this raid.

- Taken together, these adjustments would restore $500 million to the MTA in 2023.

- The Governor and Legislature should make good on historical funding commitments by increasing the 18-b and PMT “make whole” payments through general fund contributions instead of raiding the Metro Mass Transportation Operating Assistance fund (MMTOA), and adjusting these funds for inflation. Over the last twenty years, the State has diverted a staggering $3.8 billion of promised revenue from the MTA with this raid.

- The Legislature should remit more MTA dedicated funds directly to the MTA to protect them from raids by the Executive, such as the Internet Sales Tax (A2895, González-Rojas).

- The Legislature should use the Outer Borough Transit Fund to improve bus, subway and commuter rail service rather than toll discounts. The Legislature should be looking at ways to bring transit riders back, rather than encourage more driving.

- The Governor and Legislature should work with New York City to increase the Fair Fares income threshold, allowing more individuals to enroll in the program.

MTA Capital Budget and Spending

- The MTA must get congestion pricing revenue, as only 17% of 2020-2024 capital plan funds have been received. Three years into the 2020-2024 capital program, funding is coming in at the slowest pace of the last three capital programs. Only 17% of funding has been received, or $9.7 billion. Capital spending has also slowed due to COVID-19 impacts and funding availability.

- The Legislature should include greater MTA capital dashboard transparency requirements in its one-house bills, building off of the changes made in last year’s budget, or pass stand-alone legislation sponsored by Senator Ramos and Assemblymember Bobby Carroll as part of the Fix the MTA package (to be introduced).

New York State Can Fix Penn Station Without Tax Breaks for Vornado

- The capital budget continues to provide $1.2 billion for Penn Station. The Governor and State Legislature should find other funding sources for the remaining $875 million share of the $7 billion project, eliminating the PILOTs and any tax subsidies.

- The Governor and Legislature should modernize the Penn Station reconstruction plan to increase train capacity.

- The Legislature should pass Public Authorities Control Board repeal legislation (S521, Comrie) to allow greater checks and balances on future votes, including for any Penn district sites.

Article VII Proposals (TED), Non-Operating Revenues

We support the following proposals:

- Part A, Expand Camera Enforcement for MTA Bus Operations

- Part B, Triborough Bridge and Tunnel Authority Speed Cameras

- Part F, Toll Violation Enforcement

- Part K, Allow NYC to Lower Its Speed Limit

- Part N, NYC Parking Reform

Legislature Should Hold a Hearing and Improve Contract Transparency

- Part C, MTA Tax Increment Financing and Procurement Extender

- The Legislature should hold a joint hearing on MTA tax increment financing and value capture, as it stated it intended to in the FY 2022-2023 budget, prior to extending this program. We note that legislation to be introduced by Assemblymember Mamdani as part of the Fix the MTA package would add transparency requirements to value capture mechanisms.

- The legislature should improve contract transparency by requiring the MTA to:

- publish quarterly change order reports, and

- improve existing procurement reporting to the Authorities Budget Office.

No position at this time:

- Part G, MTA Compulsory Arbitration Two-Year Extender

- Part E, Expand MTA Owner Controlled Insurance Program

- Part H, Transportation Worker Assault Prevention

- Part I, Strengthen MTA Transit Bans

Click here or below to view the full testimony.

MTA Operating Aid

$8.3B in State Operating Aid, which is Good News for the MTA and Riders.

$4.4 billion of this is appropriated, and $3.9 billion is remitted directly to the MTA. It is also good to see that the MTA’s dedicated funds are not being raided for the general fund. This will plug the MTA’s deficits in 2023 ($600 million) and beyond ($1.2 billion/year).

Below is a chart of Executive Budget proposed MTA operating aid investments from FY2019 to FY2024. This year’s total contributions provided much needed aid to the MTA, particularly when inflation and the MTA’s large drops in ridership revenues are considered (see our report, Ridership Down, November 2022, on this topic). Below is a chart of Executive Budget operating aid proposals for the MTA from FY 2018-2019 to present.

New York City Contributions

Out of the $8.3 billion, $500 million is from NYC sources rather than state sources. The City has said that it “annually contributes approximately $2 billion to the MTA in direct and in-kind contributions and, while we recognize the significant fiscal challenges the MTA faces, we are concerned that this increased commitment could further strain our already-limited resources.” City contributions would come from student Metrocard and Paratransit payments, as well as payments to offset exemptions to the Payroll Mobility Tax within the City. As described later in this testimony, we note that the State’s offsets to the PMT have not appropriately accounted for inflation, and have called upon the state to fully fund these “make whole” payments.

The Governor and Legislature should also examine ways that they can work with the City of New York to expand its Fair Fares program as a way to boost city contributions. The Fair Fares program currently caps out at very low income thresholds, which limits eligibility, and therefore the pool of individuals who can opt into the program – see the chart below.

Raiding MMTOA for the State’s 18-B Contributions

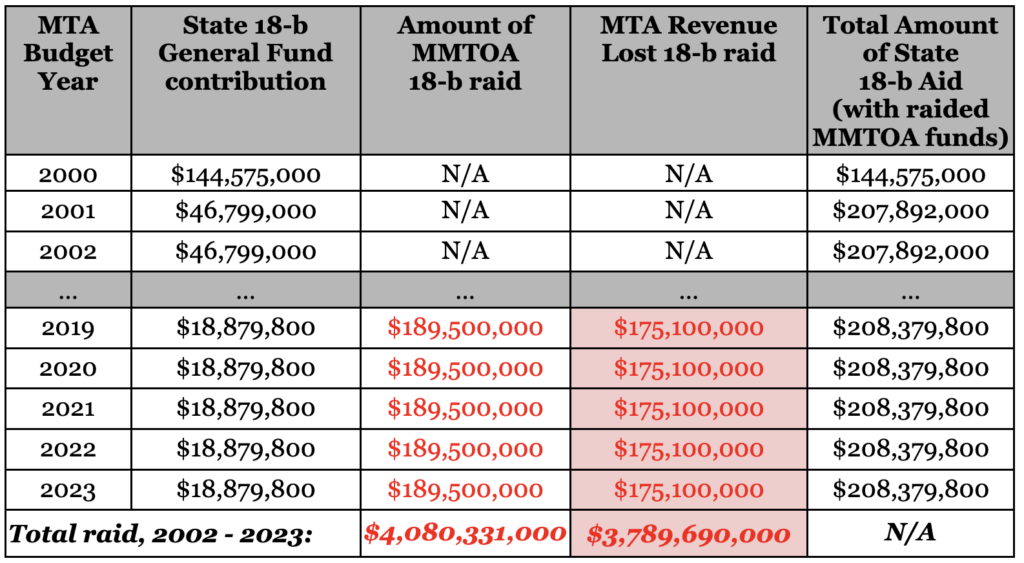

Additionally, the State is still using the MTA’s own resources to fund its 18-B contributions.

The 18-b program has been kept flat for decades. Additionally, the State has been taking $175 million annually from the Metropolitan Mass Transportation Operating Assistance fund to pay for its own contribution to the MTA. See the table below.

As shown above, the State’s raid of MMTOA for its 18-b general fund contribution has totaled $4 billion since 2002. This means that over the last twenty years, the State has diverted a staggering $3.8 billion of promised revenue from the MTA.

The 18-b program has also remained flat for decades, providing only $208 million to all transit systems each year since 2001. If it were to be adjusted for inflation, the program should be approximately $350 million a year statewide, with the MTA receiving $305 million (approx. 87%), or $125 million more annually. The 18-b program requires a 100% local match, so increasing the state amount would require an increased local contribution as well from New York City and the surrounding counties.

Adjusting 18-B and PMT for Inflation

Additionally, overall 18-b and Payroll Mobility Tax “make whole” payments have not been adjusted for inflation, as noted in our report, Skipping Out (December 2022). See the chart below of PMT and PMT “make whole” payments.

Operating Funding Recommendations:

- The Legislature should remit more MTA dedicated funds directly to the MTA to protect them from raids by the Executive. We support legislation to remit the Internet Sales Tax directly to the MTA (A2895, González-Rojas).

- The State should increase its 18-b and Payroll Mobility Tax (PMT) “make whole” payments to adjust for inflation, and stop raiding MMTOA – these measures would increase MTA funding by $500 million/year.

- The 18-b program should be increased to $350 million a year for all downstate systems. This would provide $125 million more for MTA alone.

- Adjusting the Payroll Mobility Tax (PMT) replacement funds (currently at $244 million) for inflation would provide the MTA with $200 million more annually.

- The State should also use general fund resources rather than MMTOA to fund its 18-b contribution, particularly as it is asking the City to make larger contributions to the MTA. This would restore $175 million to the MTA.

- The Legislature should use the Outer Borough Transit Fund to improve bus, subway, and commuter rail service rather than provide toll discounts. The Legislature and MTA should be looking at ways to bring transit riders back, rather than incentivizing more driving. OBT funds beyond the amount used for the Subway Action Plan ($300 million a year) may arrive soon, and the DOB-approved possible project list was last updated in 2019, before COVID-19 hit. Any final list of projects should be voted on by the Capital Program Review Board (CPRB) in a public meeting.

- The Governor and Legislature should work with New York City to increase the Fair Fares income threshold, allowing more individuals to enroll in the program.

MTA Capital Budget and Spending

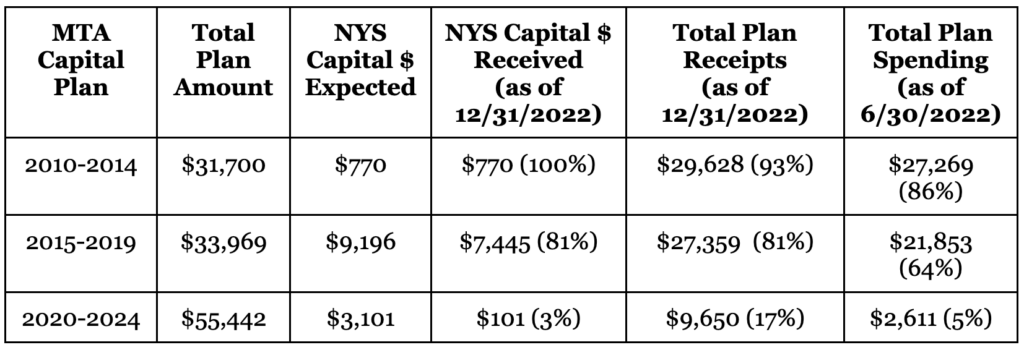

There is no new capital funding for the MTA in the budget this year, only reappropriations for the 2015-2019 and 2020-2024 capital plans. According to the latest MTA documents, state capital funds are still due for the last two capital plans. The only funding received by the state for the 2020-2024 capital plan has been for Penn Station reconstruction design work. Funds received by the MTA for each of its capital plans is below (in millions):

Historically, transit advocacy has centered on finding funds, but Reinvent Albany has looked at actual expenses – not “commitments” as the MTA does. The MTA considers commitments the time when funds are planned to be used in the future when a contract is signed, or they intend to use employees to complete a project. This is not the same as actual spending on employees or paying a contractor. Commitments are the first step in a lengthy process, expenditures the last.

Capital plan spending for the 2020-2024 plan has been sluggish, with only just over $2.6 billion spent out of the $55B plan (5%), as seen above. This has been due to factors including COVID-19 and a pause on capital projects, as well as delays to congestion pricing. These challenges have exacerbated the MTA’s existing difficulty to spend capital dollars quickly. The 2010-2014 program, for example, totals $32B and 86% has been spent 12.5 years after the nominal start of the program, per the most recent data from June 2022.

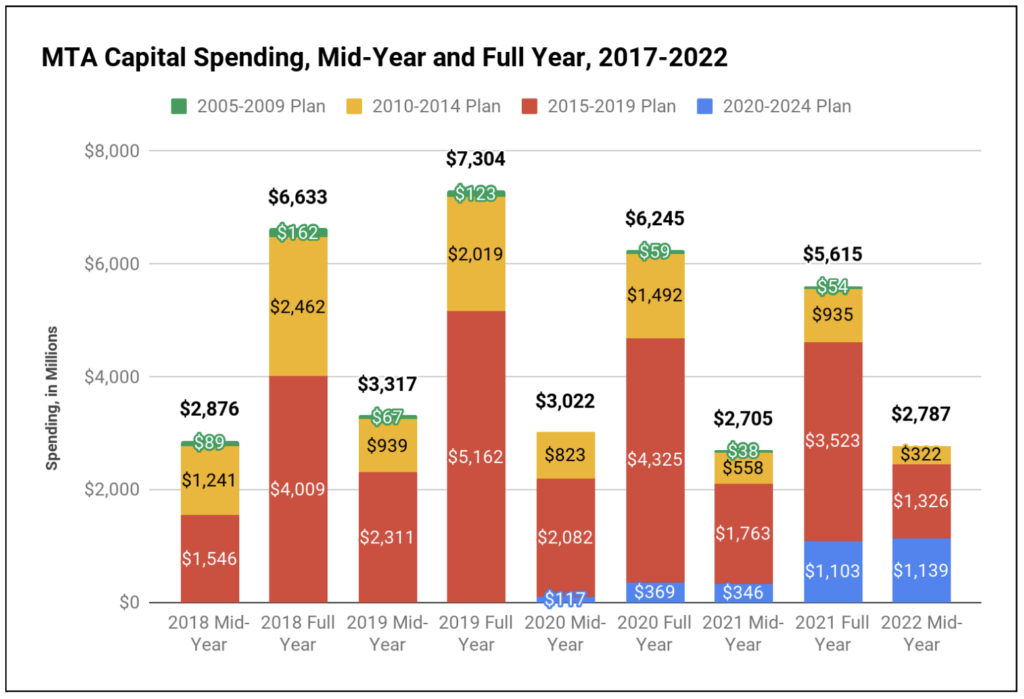

As seen below, the MTA was able to pick up the pace of its capital spending in 2019, but those gains were eroded during COVID in 2020 and have continued through the first half of 2022. Note that the chart below has not been adjusted for inflation – this would show an even larger gap in spending. Additionally, the lack of congestion pricing funds, which were anticipated to start arriving in 2021, is likely a factor of the slower pace because fewer dollars are available. As previously noted, spending is different from the commitment of funding, and a better gauge of how much of each capital plan has been completed.

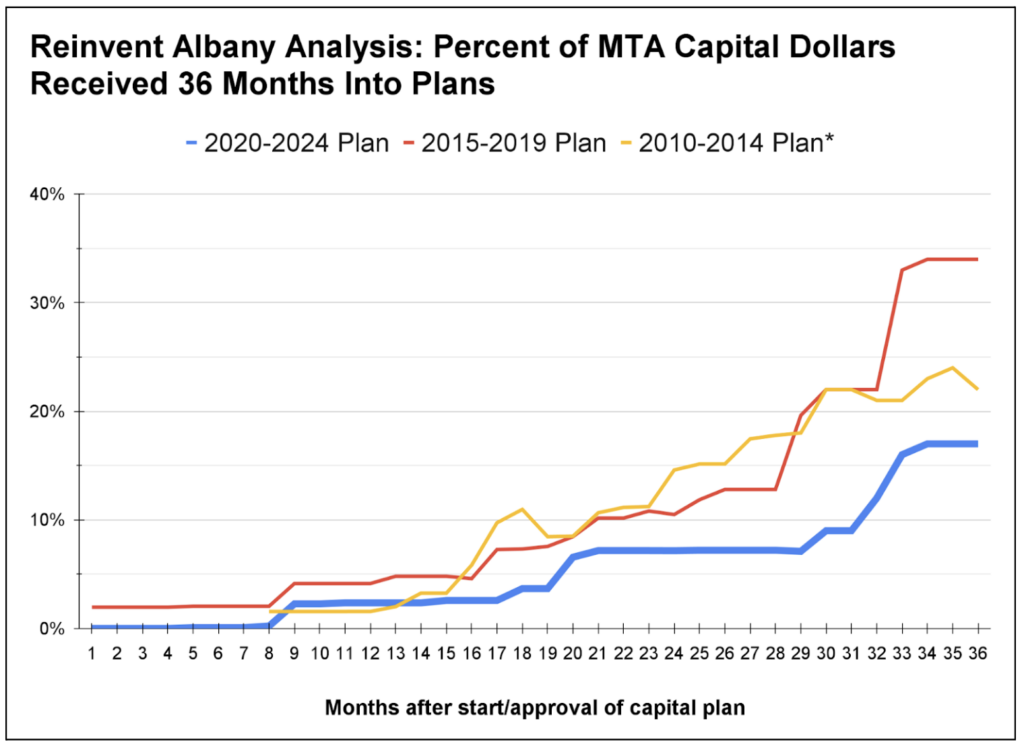

Congestion pricing remains urgent given the slow pace of funding and capital spending on the 2020-2024 capital program. Congestion pricing is the single largest funding source for the 2020-2024 capital program at $15B, and the MTA originally planned on this funding arriving in January 2021. The vast majority of funds for the 2020-2024 program have come from the federal government ($6.3B of the $9.7B received is from federal formula funds – about two-thirds of all receipts). The City of New York has provided $887M in funding, compared to $101M from the State, which is for Penn Station design work.

The 2020-2024 plan dollars have come in at the slowest pace of the last three plans two years after the start of the program, when looking at the total percentage of funding that has been received in three years. In the chart below, we update our analysis from August 2021, MTA Needs Congestion Pricing Money Now, Not in 2023. The 2020-2024 plan has received $9.7B three years in, compared to $11.4B for the 2015-2019 plan and $7.6B for the 2010-2014 plan. The 2020-2024 plan is the biggest by far at $55B rather than $34B and $32B, respectively. Three years into the 2010-2014 program, the MTA had 22% of the cash it needed in the bank to start spending on the capital program, and the 2015-2019 plan was further ahead at 34%. The MTA has only 17% of the funds needed to fund the 2020-2024 program as of December 2022, as shown below.

Capital Spending Recommendations

- The MTA must get congestion pricing revenue, as only 17% of 2020-2024 capital plan funds have been received. Three years into the 2020-2024 capital program, funding is coming in at the slowest pace of the last three capital programs, with only 17% of funds received, or $9.7 billion. Spending has also slowed.

- The Legislature should include greater MTA capital dashboard transparency requirements in its one-house bills, building off of the changes made in last year’s budget, or pass stand-alone legislation sponsored by Senator Ramos and Assemblymember Bobby Carroll as part of the Fix the MTA package.

New York State Can Fix Penn Station Without Tax Breaks for Vornado

The future of Penn Station does not depend on the success or even survival of struggling real estate developer Vornado, which is being crushed by debt and pandemic commuting patterns, and recently wrote down their portfolio due to Midtown property value losses.

New York State planning documents say the State will pay $1.75 billion of the $7 billion needed to fix Penn Station (25%), with the feds (50%) and New Jersey (25%) paying the rest. As part of its funding, New York budgeted $875 million from Payments in Lieu of Taxes (PILOTs) from new Vornado office towers in the Penn Station area. (These PILOTs are New York City property taxes diverted to the state.)

Given Vornado’s bombshell announcement in November 2022 that it was delaying all new development around Penn Station for an indefinite period, some observers have wrongly concluded that Vornado’s woes will delay fixing Penn Station.

Now the Governor and Legislature can relatively easily find $875 million more in NYS capital funds elsewhere and move quickly to fix Penn. The FY2024 budget reappropriates $1.2 billion in the capital budget for below ground transportation improvements at the Penn Station project ($100 million has been spent on design by the MTA). For some perspective, $875 million is only 1.5% of the current MTA capital plan or 8.25% of the new Green CHIPS tax break.

There is no reason the Vornado Iceberg should sink Penn Station commuters. The Governor, Senate, and Assembly should find the funds to fix Penn Station, modernize the plan to improve capacity as requested by Senator Comrie and others, eliminate any tax subsidies, and end the magical thinking and free money fever dreams that have plagued the Penn Station redevelopment project from day one.

Article VII TED Proposals (Non-Operating Revenues)

Part A, Expand Camera Enforcement for MTA Bus Operations – Support

Reinvent Albany strongly supports Part A to allow New York City to allow automated enforcement via cameras for bus lanes. This will help to speed up buses, making them more attractive for riders and help bring people back to transit. We also support S153 (Krueger)/A2610 (Hyndman), a similar proposal in the Legislature.

While we have no position on the specific penalties or procedures in the legislation, we support the State granting New York City the authority to expand camera enforcement to include additional types of violations of City traffic rules, and the MTA expanded ability to deploy enforcement cameras in their buses.

We also strongly support the removal of the sunset date of the automated bus lane enforcement (ABLE) program. New York City and the MTA should not need to continue to lobby Albany to ensure this beneficial and cost-effective program continues.

Part B, Triborough Bridge and Tunnel Authority Speed Cameras – Support

Reinvent Albany strongly supported legislation that was signed by the Governor to allow school speed cameras to operate 24/7. We also support granting MTA Bridges & Tunnels the authority to use speed cameras, though have no position on the specific penalties or procedures in the legislation.

Part C – MTA Tax Increment Financing and Procurement Extender – Hold a Joint Hearing on TIFs and Improve Contract Transparency

Given the opaque manner in which the Penn Station redevelopment project was approved, we continue to have a number of concerns about the proposed extension of the Tax Increment Financing allowance under the General Municipal Law Section 119-R. We note that this mechanism has not yet been used – the Penn project is proceeding under the Urban Development Corporation law. Therefore there is no clear use case for the project that has been publicly discussed.

There are three separate value capture mechanisms proposed to be extended in the budget:

- Tax increment financing: “the allocation of an increment of property tax revenues in excess of the amount levied at the time prior to planning of a mass transportation capital project.”

- Special transportation assessments: “imposed upon benefited real property in proportion to the benefit received by such property from a mass transportation capital project, which shall not constitute a tax.”

- Land value taxation: “the allocation of an increment of tax revenues gained from levying taxes on the assessed value of taxable land at a higher rate than the improvements, as defined in subdivision twelve of section one hundred two of the real property tax law.”

These mechanisms can be combined, and local governments may “conditionally or unconditionally grant or pledge a portion of its revenues allocated” under the law. This means that PILOT payments could be discounted in the form of subsidies to developers.

Reinvent Albany does not oppose capturing any of the increased value that is generated from transit improvements to fund those mass transit projects. However, it must be done transparently and the public should fully understand all the assumptions that are being made. We note that legislation to be introduced by Assemblymember Mamdani and Senator Comrie as part of the Fix the MTA package would add transparency requirements to value capture mechanisms, and only allow certain of these mechanisms to be extended.

We do, however, oppose the ability of local governments to discount PILOT payments made by developers. Discounted PILOT payments are essentially subsidies that are not reported as actual expenditures which could go to fund other local services like education or sanitation.

Part C additionally makes a number of procurement changes:

- Repeals subdivisions 1, 2, 3, 4 and 6 of Section 1209 of the public authorities law related to New York City Transit contracts. These require competitive, sealed bids for public works contracts over $20,000, and purchase contracts for goods over $10,000. Additionally, they put in place requirements regarding purchases of subway cars and buses, allowing negotiation without competitive bidding with additional notice and public hearing requirements. These requirements are currently not in effect, but would be triggered again after June 30, 2023.

- Applies requirements from 1265-c of the Public Authorities Law regarding competitive bidding to all of the MTA’s subsidiaries and affiliates.

- Changes made in 2016 and extended in 2021 related to lowest cost requirements under 1209, 1265-a and 553 of the public authorities law will expire and be repealed on April 1, 2024.

These changes appear to be made to standardize procurement between the MTA’s subsidiaries and affiliates. The Governor’s Memorandum in Support states that the intent is to “…make permanent certain MTA procurement provisions and eliminate[s] dormant provisions which they replaced.” We urge the Legislature to generally require more transparency of MTA contracting while it considers repealing these provisions.

TIF and Procurement Recommendations:

- The Legislature should hold a joint hearing on MTA tax increment financing and value capture as it stated it intended to in the FY 2022-2023 budget, prior to extending this program. This would allow the Legislature to understand potential use cases for and risks inherent to such financing schemes, and learn more from national experts about how value capture has worked elsewhere. There are a number of experts on TIFs, including the Citizens Budget Commission, Good Jobs First, Bridget Fisher of the New School, Eric Kober of the Manhattan Institute, and Rachel Weber at the University of Illinois – Chicago who could be invited to the hearing (see our blog post on TIFs for more information about these scholars).

- The Legislature should require the MTA to publish quarterly change order reports, and improve existing procurement reporting to the Authorities Budget Office. This should be accomplished through:

- Reinstatement of quarterly change order reports to the MTA Board and public, and release of change order information as open data, as required by Senator Comrie and Assemblymember Carroll’s MTA Open Data Act, which was signed in October 2021 by Governor Hochul.

- Improvements to the MTA’s existing reporting to the Authorities Budget Office, by requiring the MTA to list contract numbers and the number of change orders in their annual procurement report.

Part F, Toll Violation Enforcement – Support

Reinvent Albany supports measures to discourage toll evasion such as increased fines for defacing or obscuring license plates for her MTA and Port Authority bridges. Effective enforcement is particularly important for the integrity of the congestion pricing program in order to ensure the public is confident that the tolls are fair, and no one who is required to pay the tolls is able to avoid them without penalty.

Part K, Allow NYC to Lower Its Speed Limit – Support

Reinvent Albany supports Sammy’s Law, S2422 (Hoylman-Sigal), and its inclusion in the budget to grant New York City greater authority over its speed limits. In particular we note that it requires NYC to provide written notice and an opportunity for public comment before a community board if the City raises a speed limit by more than 5 mph. Currently there is only comment required if the City lowers a speed limit by more than 5 mph.

Part N, NYC Parking Reform – Support

We support this provision, as it would increase the maximum fines for parking certain overweight vehicles overnight in New York City’s residential neighborhoods to $400 for a first offense and $525 for subsequent offenses within six months. It would also importantly close loopholes in the Vehicle and Traffic Law to ensure that penalties apply to drivers who park illegally with invalid or missing license plates, prolong the statute of limitations for summonses dismissed as the result of fraud, and amend the process by which drivers may appeal parking violations. These measures are important for public confidence and fairness, particularly given concerns that individuals are avoiding paying fines.

Reinvent Albany supports the Article VII TED proposals that relate to home rule issues. In general, we believe the state should grant localities permanent authority to:

- Set maximum speed limits;

- Create and operate automated traffic enforcement camera programs including hours of operation, number and type of cameras, locations and penalties;

- Establish Residential Parking Permit programs; and

- Use automated parking enforcement.