Watchdog Testimony to City Council on Three New Campaign Finance Bills

Oversight Hearing on NYC Campaign Finance Board and Laws

Good morning, Chair Restler and Committee on Governmental Operations. I am Tom Speaker, Legislative Director for Reinvent Albany. We work for transparent and accountable government, including clean, fair elections. Thank you for holding this hearing today.

First, a special thank you to Chair Restler and his staff for reaching out to Reinvent Albany and consulting with us and our colleagues with expertise in campaign finance administration. We really appreciate Chair Restler’s energy and willingness to take on some thorny problems.

Reinvent Albany’s staff is extremely familiar with the major issues faced by the NYC campaign finance system and the Campaign Finance Board (CFB), and collectively we have worked on these issues for decades. Broadly, we think the New York City campaign finance system is not in crisis, public matching funds are well protected, and that the CFB does a very good job protecting public funds while helping campaigns navigate complicated rules and getting them matching funds.

We think New York City public matching funds are safe, despite the inevitable, highly publicized attempts to steal them. Pause for a moment and consider this – according to the FBI, every year there are over 100 bank robberies in New York. Yet no one believes this is a crisis or a crime wave. Why? Because bank robbers get caught, and very few get away to spend their loot in peace. But they still keep on trying – because that’s where the money is.

Dirtbags are always going to try to steal New York City’s public matching funds. Like bank robbers, they cannot be stopped from trying, but they can almost always be caught, and in the case of the straw donors, illegal bundlers, and other crooks, we think they almost always are.

The key challenge for this City Council and the Campaign Finance Board is to keep the bank open for honest users, while making sure the bad guys are identified and do not get away, and we think CFB is doing that. We looked at the CFB’s latest data on campaigns that got public matching funds in the 2017 election cycle, and found that 86% of 2017 campaigns were not penalized or paid minor fines (67% paid no fines, 19% paid fines of $5,000 or less).

The CFB is doing excellent work getting matching funds to campaigns and keeping those funds safe – so why is there so much complaining from campaigns and the press? The simple answer is that too many audits – including most high-profile audits – take far too long to wrap up. We understand this is annoying to campaigns, who want to close the book on activities that took place three or four years ago. We also know slow audits irritate the press and public because fines that are imposed years after violations make the CFB appear weak and ineffectual at safeguarding public funds.

We know there is always going to be some dissatisfaction with a system that punishes offenders after the campaign audit is completed rather than when they are caught, but that is an inherent part of the NYC campaign finance process and is difficult to change. However, the CFB can hugely reduce the time it takes to do audits, and our understanding is that this is their new administration’s top priority.

Reinvent Albany sees three major problems for the New York City campaign finance system, not all of which can be fixed by the City, the Council, and the CFB:

- Independent expenditures are a highway off-ramp for big-money contributors.

- Audits take too long, which undermines public confidence in CFB and the system.

- Rules on doing business and intermediaries are full of giant loopholes and inconsistencies that undermine confidence in the fairness of the system.

Generally, Reinvent Albany believes that the broadest possible disclosure of campaign fundraising activities is preferable to continuously increasing restrictions on a fairly small segment of those active in campaigns and governance. In other words, we would strongly support expanding the definition of “doing business” over further restricting what those already classified as doing business can do. For instance, it makes no sense to us that the members of the board of a nonprofit that has hundreds of millions of city contracts are not considered to be doing business, while maybe three or four out of hundreds of that organization’s staff are.

Reinvent Albany Position on Proposed Council Bills

Int. 952 of 2024 (Restler) – In relation to the verification of intermediated contributions to candidates for election and contributions requiring contribution cards

Reinvent Albany opposes this bill as written.

This bill requires the CFB to make “reasonable efforts” to verify with bundled donors that their donations are genuine. The CFB must attempt to contact the donor when their contribution to a candidate exceeds $50, and also establish a clearer timeline under which campaigns must respond to inquiries about intermediaries. Campaigns that do not respond to the CFB within 30 days would be disqualified from receiving matching funds and have this change of status publicly posted.

Though well intentioned, we think this bill would create undue work for CFB, and probably slow down audits by consuming a large amount of the time of staff who verify donor information. We also believe it would discourage small donors by requiring them to verify their identity with the CFB. Finally, small campaigns with limited resources could be forced to endure public humiliation when disqualified from receiving funds.

The most widespread complaint about the public matching program is that audits take too long. Given this, we believe the Council should instead pass legislation that accelerates the auditing process and create more transparency (without, of course, reducing the CFB’s independence or oversight). As written, this bill will add an unnecessary administrative layer that ultimately harms the program.

We do support the provision in this bill that requires email and telephone numbers to be supplied with donations, as this will speed up the CFB’s audit process.

Int. 953 of 2024 (Restler) – In relation to limiting bundling of campaign contributions by persons who have business dealings with the city

Reinvent Albany supports this bill, but is concerned that it may lead to less disclosure from candidates.

The bill would make it so that individuals in the doing-business database cannot bundle more than the doing-business contribution limit for individual candidates. For example, a lobbyist for Reinvent Albany could not bundle more than $400 for a mayoral candidate, as $400 is the doing-business contribution limit.

On principle, letting individuals in the DBD fundraise for candidates creates an obvious risk for undue influence and hurts public trust. However, we have heard that there has been a drop in disclosure of bundling from campaigns, possibly due to the new restrictions that prohibit bundled donations from being matched. If this is true, it’s possible that this bill could further discourage disclosure, which is why we believe that strengthening disclosure rules is preferable to increasing restrictions.

Before moving forward, we ask the Council to closely examine campaign finance data to determine what effect new laws have had on disclosure on bundling.

Int. 954 of 2024 (Restler) – In relation to acknowledgment of campaign contributions made in connection with covered elections

Reinvent Albany does not support this bill as we are unsure of its cost. We urge the Council to request a cost analysis from the CFB before moving forward. The CFB already has limited resources, and this bill may further strain the agency.

We encourage the Council to consider the following:

1. Require campaigns to quickly report all event intermediaries to the CFB once a certain amount is raised. NYC Law designates a single person as the intermediary for a fundraiser, even if multiple people were involved in organizing the event (NYC Charter §3-702(12)). Further, intermediaries are only required to report for house parties if the party’s expenses exceed $500 (NYC Charter §3-703(6)(b)(i)). When the cost exceeds $500, the house party must be reported as an in-kind contribution to the campaign. However, if the house party costs under $500 and a single contribution exceeds $500, one of the hosts must be reported as an intermediary for that contribution.

We recommend making it so that if a certain amount is raised at the event, all organizers would be considered intermediaries. Though it would require more frequent reporting, the law would bring a great deal of sunlight to bundling in NYC.

2. Close the doing-business loophole that requires lobbyists, but not the people paying them, to be included in the DBD. This absurd loophole subverts the basic goal of doing-business restrictions, which is to reduce the potential for pay-to-play. Under current law, a wealthy person and their family face no doing-business restrictions when they pay a lobbyist millions of dollars to influence legislation. This makes no sense, since the lobbyist faces restrictions for working to advance the interests of their clients, but the clients themselves do not.

3. Close the doing-business loophole that exempts board members and officers of organizations with billions of dollars in New York City contracts from being listed as doing business. New York City pays out billions a year to non-profit organizations providing social service and health services. The board members of those organizations face no restriction on their campaign contributions, bundling, or acting as an intermediary. Indeed, it is common to see board members of these organizations acting as co-hosts for campaign events. This is a massive opportunity for pay-to-play by some of the most politically active people in New York City – which is why this crucial reform languishes.

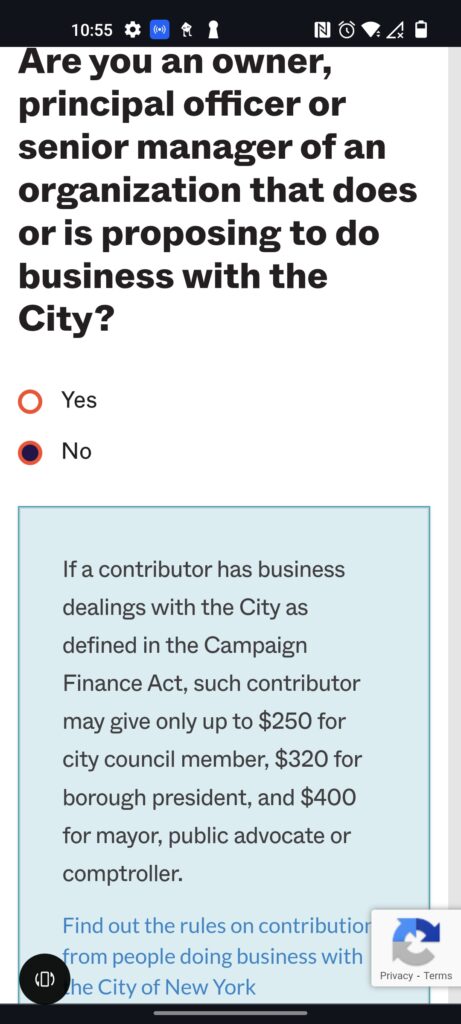

4. Ask CFB to assess how it can use online credit card donation forms and other technology to increase compliance with the law. Over 80% of contributions campaigns report to CFB are via credit card, most via third party vendors like ActBlue. Some campaigns for NYC office already attempt to use their ActBlue contribution pages to ensure donors are complying with doing-business restrictions, per Example 1 below.

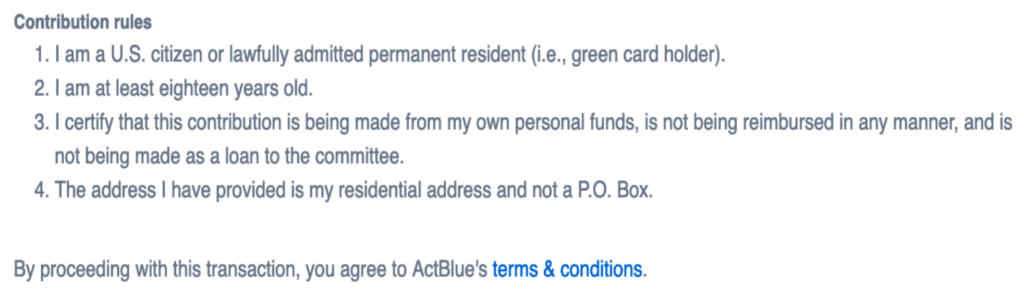

Why not have all credit card donors click a yes/no box like this for all contribution rules – like using text below (Example 2) from an ActBlue page for a state candidate – so that the donor has to proactively acknowledge they have read the basic rules and are complying with them before their contribution is processed?

Thank you for allowing me to testify. I welcome any questions you may have.

Example 1

Example 2