Watchdog testimony for NYS budget hearing on MTA and Penn Station

February 15, 2022

Goodday, my name is Rachael Fauss, and I am the Senior Research Analyst for Reinvent Albany. Reinvent Albany advocates for transparent and accountable government. We are presenting our thoughts on the transportation components of the FY 23 Executive Budget, in particular as pertains to the MTA.

Below is a summary of recommendations and findings from our testimony; the full rationale for our recommendations and further analysis of MTA capital spending and ridership trends is detailed in the full testimony.

Operating Aid

- $6.6B in state operating aid, mostly from MTA dedicated tax revenues, is good news for the MTA and riders, but only up 6% from where we were pre-COVID.

- The MTA should annually provide the Legislature and public updated ridership projections including worst-, mid- and best- case scenarios.

- The MTA faces a financial cliff when federal aid runs out in 2025, and will need billions in new dedicated revenues.

- The Legislature should remit existing and future MTA dedicated funds directly to the MTA to protect them from raids by the Executive.

- The Legislature should use the Outer Borough Transit Fund to improve bus, subway and commuter rail service rather than toll discounts. The Legislature should be looking at ways to bring transit riders back, rather than encourage more driving.

Capital Budget and Spending

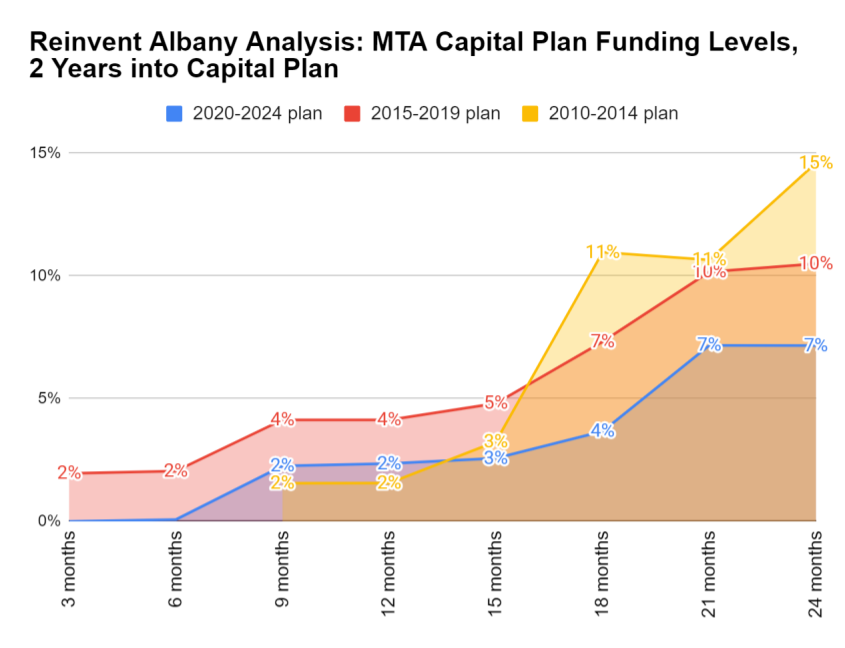

- The MTA must get congestion pricing revenue, as only 7% of 2020-2024 capital plan funds have been received. Two years into the 2020-2024 capital program, funding is coming in at the slowest pace of the last three programs. The MTA only has $4B on hand of the $55B it needs to complete the program.

- MTA capital spending slowed in 2020 and 2021, due to COVID-19 impacts and delays to congestion pricing. COVID-19 exacerbated the MTA’s existing challenge of quickly spending capital dollars.

Penn Station

- The Legislature must ensure that ESD is fully transparent about the financing plan for Penn Station, as called for by the NYC Planning Commission. This should include the risks to the taxpayers if development does occur as hoped, exact amounts of NYC property tax revenue being captured by the state, the level of PILOT compared to NYC property taxes, and full cost of any subsidies for Vornado.

- As part of this, the Legislature should carefully review the forthcoming IBO report on Penn Station financing and the potential risks to NYC and the public at large.

- The Legislature should examine alternative funding mechanisms, such as direct state budget funding for Penn Station beyond the $1.3B reappropriation.

Article VII Proposals (TED)

- Part H – The Legislature should include the Governor and MTA’s design build proposal in their one-house bills, giving the MTA more flexibility in awarding major contracts.

- Part I – MTA Procurement

- The legislature should reject the “piggybacking” proposal, which would allow the MTA to select vendors used by state and local governments outside of New York that may not have the same anti-corruption and competitive bidding standards as NYS.

- The legislature should require the MTA to publish quarterly change orders reporting, and improve existing procurement reporting to the Authorities Budget Office, including in open data format as required by the MTA Open Data Act.

- Part J – The Legislature should NOT authorize the MTA Tax Increment Financing/Value Capture Extender as part of the budget. The legislature should hold a separate hearing on MTA tax increment financing and value capture.

- Parts M and N – The Legislature should include automated Bus Lane and Toll Enforcement in its one house bills. We strongly support automated enforcement of bus lane violations. We also strongly support congestion pricing and measures to discourage toll evasion.

- The legislature should approve Mayor Adams’s call for home rule to allow NYC to manage camera enforcement programs and control speed limits.

Please note that we have no position on the following Article VII proposals:

- Part K – Utility Relocations

- Part L – MTA Worker Assault

Revenue Budget

- Part T – We oppose the $2 million “Tug Boat Tax Credit,” which would reduce funds for mass transit coming from the Petroleum Business Tax. The Legislature should not include this proposal in its one-house budget bills, and instead look at ways to ensure the tax applies equally to all private operators.

Our full testimony touching on these recommendations is provided here (PDF) and below.

$6.6B in State Operating Aid, Mostly from Dedicated Tax Revenues, is Good News for the MTA and Riders, but Only Up 6% from Pre-COVID Expectations

It is good news for the MTA and riders that the FY 23 Executive Budget provides $6.6B in on- and off-budget state funding for the MTA. This will stave off MTA fare and toll increases in 2022. It should be noted that this increase is due to dedicated taxes booming, not additional state contributions beyond the formulas already set in law. The state financial plan shows continuing growth in MTA dedicated taxes in FY 24.

However, the increase to $6.6B should be viewed not in comparison to the FY 22 budget, but from where the MTA stood before COVID. This is a more accurate gauge of how the MTA is recovering financially from COVID-19. The budget released in January 2020 forecast that the MTA would receive $6.2B, but this was later reduced to $5.2B. Therefore, this year’s increase in funding should be compared to $6.2B, which is a 6% increase rather than a 18% increase from last year’s COVID-decimated budget.

Lastly, it is good to see that the MTA’s dedicated funds are not being raided for the general fund, or subject to the budget gimmickry of the past.

Recommendation:

- The Legislature should remit existing and future MTA dedicated directly to the MTA to protect them from raids by the Executive. We support remitting additional MTA dedicated funds – either newly created or existing pots – directly to the MTA. They would no longer be subject to appropriation, limiting the chance of raids by the executive.

- The Legislature should use the Outer Borough Transit Fund to improve bus, subway and commuter rail service rather than toll discounts. Drivers have come back in full force, while transit ridership is still down. The Legislature and MTA should be looking at ways to bring transit riders back, rather than incentivizing more driving. OBT funds are expected to arrive for the first time in 2022 and the DOB-approved possible project list was last updated in 2019, before COVID-19 hit. Any final list of projects should be voted on by the Capital Program Review Board (CPRB) in a public meeting.

The MTA Faces a Financial Cliff when Federal Aid Runs Out in 2025, and Will Need Billions in New, Dedicated Revenues

The future is still uncertain for the MTA given its continued depressed ridership, which is not rebounding as fast as anticipated. In January 2022, subway ridership averaged 46% compared to weekdays in 2019. Pre-Omicron, subway ridership reached a peak of 3.4 million or just shy of 60% for weekdays in December 2021. Total transit ridership – subways, buses and commuter rails – is currently trending below McKinsey’s mid-point projections for ridership at only 49% of 2019 levels in 2022 to date. The MTA broke 3 million daily riders last week, but this is still below the mid-point projections. (McKinsey projected ridership at about 68% in the first quarter of 2022, climbing up to 85% by the end of 2022. 3 million riders is about 55% of 2019 expectations.) The McKinsey report is now out of date, however, with the December 2020 document predicting the “epidemiological end of the pandemic” in the first quarter of 2022.

The different waves of the COVID-19 epidemic have dramatically changed the MTA’s world. We have looked at the numbers, and they clearly show the MTA will face a financial cliff when federal aid runs out.

Recommendation:

- The MTA should annually provide the Legislature and public updated ridership projections including worst-, mid- and best- case scenarios. If the MTA would like to engage outside experts like McKinsey or others on these projections, they should do so quickly. Updated projections are essential for our state leaders to understand the MTA’s challenges, and we believe will show the urgent need for large, new dedicated revenue sources in the years to come.

- Begin planning for the MTA’s future operating needs now. It would be far better for the Governor and our state legislators to begin planning now for new, lockboxed MTA revenue so the MTA can plan ahead, both in terms of its workforce and service levels. Making investments in these areas takes time, and the MTA, Governor and State Legislature should begin working together now to plan for the MTA’s future.

MTA Capital Funding in Budget All Reappropriated, but Still Not Spent

There is no new capital funding for the MTA in the budget this year due, only reappropriations for the 2015-2019 and 2020-2024 capital plans. According to the latest MTA documents, significant amounts of state capital funds are still due for the last two capital plans. Funds received by the MTA for each of its capital plans is below (in millions):

| MTA Capital Plan | Total Plan Amount | NYS Capital $ Expected | NYS Capital $ Received (as of 12/31/2021) | Total Plan Receipts (as of 12/31/2021) | Total Plan Spending (as of 9/30/2021) |

| 2010-2014 | $31,696 | $770 | $770 (100%) | $29,640 (94%) | $26,777 (85%) |

| 2015-2019 | $33,969 | $9,901 | $5,248 (58%) | $24,995 (74%) | $19,686 (58%) |

| 2020-2024 | $55,334 | $3,000 | $0 (0%) | $3,961 (7%) | $1,159 (2%) |

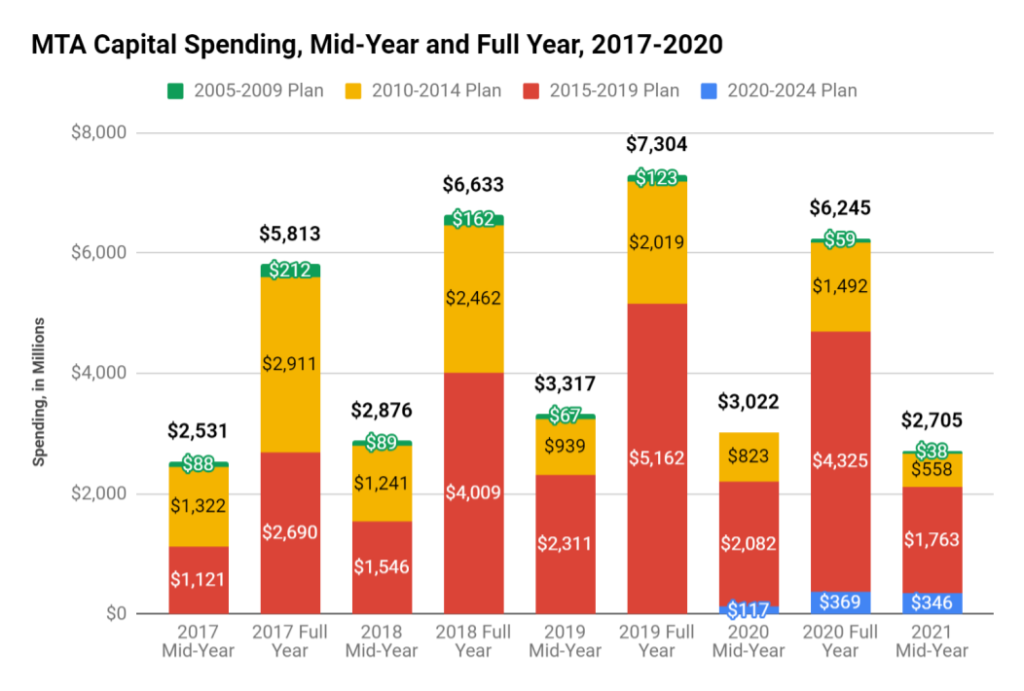

Capital plan spending for the 2020-2024 plan has been sluggish, with only just over $1 billion spent out of the $55B plan, as seen above. This has been due to factors including COVID-19 and a pause on capital projects, as well as delays to congestion pricing. These challenges have exacerbated the MTA’s existing difficulty to spend capital dollars quickly. The 2010-2014 program, for example, totaled $32B and is only 85% spent as of the most recent data from September 2021, 11 years after the nominal start of the program. As seen below, the MTA was able to pick up the pace of its capital spending in 2019, but those gains were eroded during COVID in 2020 and the first half of 2021.

We highlight the urgency of congestion pricing given the slow pace of funding and capital spending on the 2020-2024 capital program. Congestion pricing is the single largest funding source for the 2020-2024 capital program at $15B, and the MTA originally planned on this funding arriving in January 2021. None of the $3B contribution from the state has been received so far; the vast majority of funds for the 2020-2024 program have come from the federal government ($2.8B of the $4B received is from federal formula funds).

The 2020-2024 plan dollars have come in at the slowest pace of the last three plans two years after the start of the program, when looking at the total percentage of funding that has been received. In the chart below, we update our analysis from August 2021, MTA Needs Congestion Pricing Money Now, Not in 2023. While the 2020-2024 plan received $4B two years in compared to $3.5B for the 2015-2019 and 2010-2014 plans during the same period, the 2020-2024 plan is the biggest by far at $55B rather than $34B and $32B, respectively. Two years into the 2010-2014 program the MTA had 15% of the cash it needed in the bank to start spending on the capital program. For the 2020-2024 plan, two years into the five-year plan, the MTA only has 7% of the funds needed to fund the program.

ESD Must Tell the Public Exactly How it Will Fund Penn Station Improvements

The capital budget provides $1.3B for transportation improvements for Penn Station, with the specific requirement that these funds not be used on above-ground development through the Penn Station General Project Plan (GPP) – the real estate development plan advanced by Empire State Development. This appropriation begs the question of why the state is not seeking to fully fund Penn Station improvements through the budget or the MTA’s capital plan.

Instead, ESD is proposing a highly questionable and opaque financing scheme in which NYC tax revenue would be siphoned off through Payments in Lieu of Taxes (PILOTs). PILOTs would be bonded against to fund the Penn Station improvements. Given huge real estate development risks, Penn Station development bonds have to be government-backed to be affordable through “credit enhancement mechanisms.” The taxpayer would front the bond payments and risk until revenue from development is available. ESD intends to basically replicate the financing used in Hudson Yards for the 7 train. State-backed bonds paid back with future PILOT revenue from real estate development will not be available until after construction is complete or far along. In this public-private partnership with Vornado the public bears the risk, because if development revenues don’t come in, the state and its taxpayers will be on the hook.

The New York City Planning Commission has it exactly right: the financing of the GPP “must be concretely resolved prior to affirming the GPP.” It would be irresponsible for the state and city to sign off on this project without knowing exactly how much PILOTs could raise, and exactly how much Vornado would receive in subsidies.

Reinvent Albany, with BetaNYC, Common Cause/NY, Tri-State Transportation Campaign, Senator Hoylman, former Councilmember Kallos, and Community Boards 4 and 5, has asked the NYC Independent Budget Office to conduct a review of the impact on NYC of the Penn Station project. We believe the Legislature must consider IBO’s report analysis as part of reviewing this project and deciding if it should move forward.

Recommendation:

- The Legislature must ensure that ESD is fully transparent about the financing plan for Penn Station, as called for by the NYC Planning Commission. This should include the risks to the taxpayers if development does occur as hoped, exact amounts of NYC property tax revenue being captured by the state, the level of PILOT compared to NYC property taxes, and full cost of any subsidies for Vornado.

- As part of this, the Legislature should carefully review the forthcoming IBO report on Penn Station, seeing what questions are raised that must be answered by ESD.

- Further, the Legislature should examine alternative funding mechanisms, such as direct state budget appropriations.

Article VII TED Proposals

Part H – Design Build – Support

Reinvent Albany supports the Governor and MTA’s proposal to increase the threshold for which design build is mandated to be used from $25 million to $200 million for new projects, and $400 million for rehabilitation or replacements. This proposal would not preclude the MTA from using design build for projects under these new thresholds; it would simply provide the MTA greater flexibility. Procurement is highly complex, and we generally do not believe that across-the-board mandates for particular models are effective for every contract. What is more important is ensuring transparency and that competitive processes allow multiple vendors to offer bids, thus driving costs down.

Recommendation:

- Include Part H in the Legislature’s one-house proposals.

Part I – Procurement

We note that the executive budget for the last several years has included a version of the proposal presented this year to make changes to MTA procurement. While we have fewer concerns about this year’s version in terms of transparency and accountability, we still believe that there should be a more comprehensive approach to MTA procurement reform.

We are troubled that there was an erosion of transparency under the prior administration, including the MTA no longer providing quarterly change order reports to the MTA Board. Being able to examine the use of change orders is an important part of evaluating the MTA’s contracting process and better understanding the drivers of cost overruns.

We also still question why the MTA should be allowed to “piggyback” on contracts made with other states and municipalities outside of New York, which may not have the same anti-corruption and competitive safeguards in place. Further, the proposal does not require that the documentation of the rationale for using an existing contract outside of New York be made publicly available as part of the MTA Board’s authorization for declaring competitive bidding impractical.

Recommendation:

- The legislature should reject the “piggybacking” proposal, which would allow the MTA to not use competitive bidding and instead select vendors used by other local and state government entities outside of NYS.

- As part of considering any MTA procurement changes, the Legislature should require the MTA to publish quarterly change order reports, and improve existing procurement reporting to the Authorities Budget Office. This is particularly important in light of a recent MTA Inspector General audit that showed that the MTA’s documentation on change orders was inadequate. This should be accomplished through:

- Reinstatement of quarterly change order reports to the MTA Board and public, and release of change order information as open data, as required by Senator Comrie and Assemblymember Carroll’s MTA Open Data Act, which was signed in October 2021 by Governor Hochul.

- Improvements to the MTA’s existing reporting to the Authorities Budget Office, by requiring the MTA to list contract numbers and the number of change orders in their annual procurement report.

Part J – “MTA Tax Increment Financing Extender”

Given the opaque manner in which the Penn Station redevelopment project is being financed, we have a number of concerns about the proposed extension of the Tax Increment Financing allowance under the General Municipal Law Section 119-R. While in principle, value capture for transit development could be a desirable mechanism to fund mass transit improvements, there are not sufficient transparency safeguards under the current law.

Value capture for transit improvements is best done before transit improvements are made. For example, had value capture been used with the 2nd Avenue Subway, the increased real estate and land values surrounding the new train line could have been captured to fund the project, since the benefit to developers, landlords and others in the neighborhood is clearly tied to the new train line being built. With the Penn Station project, the transit improvements are cosmetic under the Governor’s November 2021 announcement that prioritized Penn renovations, with no new added capacity or service. Instead, the value being captured is entirely from the upzoning and above ground public realm improvements, not from expanded transit capacity.

Ironically, ESD is not using Section 119-R in advancing the Penn Station redevelopment program, which would require local determination of a tax increment financing zone, and a local public hearing. Instead, ULURP has been completely overridden. However, the same mechanism of PILOTs being bonded against and the potential for massive developer subsidies is still allowed for under Section 119-R.

It should be noted that there are actually three separate value capture mechanisms proposed to be extended in the budget:

- Tax increment financing: “the allocation of an increment of property tax revenues in excess of the amount levied at the time prior to planning of a mass transportation capital project.”

- Special transportation assessments: “imposed upon benefited real property in proportion to the benefit received by such property from a mass transportation capital project, which shall not constitute a tax.”

- Land value taxation: “the allocation of an increment of tax revenues gained from levying taxes on the assessed value of taxable land at a higher rate than the improvements, as defined in subdivision twelve of section one hundred two of the real property tax law.”

These mechanisms can be combined, and local governments may “conditionally or unconditionally grant or pledge a portion of its revenues allocated” under the law. This means that PILOT payments could be discounted in the form of subsidies to developers.

Reinvent Albany does not oppose capturing any of the increased value that is generated from transit improvements to fund those mass transit projects. However, it must be done transparently; the public should fully understand all the assumptions that are being made.

We do, however, oppose the ability of local governments to discount PILOT payments made by developers. Discounted PILOT payments are essentially subsidies that are not reported as actual expenditures which could go to fund other local services like education or sanitation.

Recommendations:

- The Legislature should NOT authorize the MTA Tax Increment Financing/Value Capture Extender as part of the budget – The legislature should hold a separate hearing on MTA tax increment financing and value capture. The legislature should hear from experts about how this mechanism has worked in the past, and ways in which the law should be revised to ensure transparency and full public disclosure of funding calculations and potential subsidies for developers.

Part M – Traffic Enforcement for MTA Bus Operations – Support

Reinvent Albany strongly supports Part M to allow New York City to allow automated enforcement via cameras for bus lanes. This will help to speed up buses, making them more attractive for riders and help bring people back to transit.

We note that Mayor Eric Adams supported this proposal in his testimony to the Legislature, and further called for “the state to transfer home rule to New York City to manage the city’s camera enforcement programs in addition to empowering cities to control speed limits on their streets.”

Part N – Toll Violation Enforcement – Support

Reinvent Albany supports congestion pricing and measures to discourage toll evasion such as increased fines for defacing or obscuring license plates in the central business district tolling region and other MTA and Port Authority bridges. Effective enforcement is important for the integrity of the congestion pricing program.

Recommendation

- The Legislature should include Parts M and N on bus camera and toll violation enforcement in its one-house budget bills. The legislature needs to approve these measures this year in order for them to take effect when congestion pricing begins in 2023.

- The legislature should approve Mayor Adams’s call for home rule to allow NYC to manage camera enforcement programs and control speed limits.

Revenue Bill Proposal: Part T to Exempt Certain Water Vessels from the Petroleum Business Tax – Oppose

Reinvent Albany strongly opposes the proposal in the Revenue bill to provide exemptions from the Petroleum Business Tax (PBT) to tug boat operators. The PBT is used to fund mass transit, and should stay for mass transit. In general, the state should not be providing exemptions to fossil fuel taxes or subsidizing fossil fuels, as we recommended in our testimony prepared for the Environmental Conservation budget hearing.

We note that in the sponsor’s memo for separate legislation that would enact this proposal (S7875/A8626, Savino/Cusick) currently “passenger commuter ferries, recreational boaters, commercial fishing vessels, manufacturers and farmers are exempt from paying the PBT.” We believe ideally that the State Legislature should ensure that all non-public operators are paying this tax, rather than providing further exemptions to it.

Recommendation:

- The Legislature should not include the Tug Boat Tax Credit (Part T of the Revenue Bill) in its one-house budget bills, and instead look at ways to ensure the tax applies equally to all private operators.