Legislature’s One-House Budget Bills Should Honor NYS Commitments by Restoring $500M in Recurring MTA Operating Support

The State Legislature’s one-house budget bills are expected to be finalized this week, with resolutions confirming each house’s proposal voted on the week of March 13th. As the Senate and Assembly develop their proposals for MTA operating funding, they should include $500 million in recurring New York State funding commitments – in addition to one-time emergency aid proposed by the Governor.

- The 18-b program should be increased to $350 million a year for all downstate systems to account for inflation. A similar increase should be made for upstate systems. (+$125 million/year for MTA)

- The State should stop raiding MTA dedicated funds (the Metropolitan Mass Transportation Operating Assistance fund or “MMTOA”) to fund its 18-b contribution, particularly as it is asking the City to make larger contributions to the MTA. Over the last 20 years, $4B has been diverted from transit systems by this raid – see our report, Skipping Out, for more details. (+$175 million/year for MTA)

- New York State Payroll Mobility Tax (PMT) “make whole” funds to repay the MTA for exemptions (currently flat $244 million) should be adjusted for inflation. (+$200 million/year for MTA)

Most of this recurring $500 million NYS contribution to MTA is already required under the law, but has not been delivered due to budget gimmickry and has also been eroded by inflation. We note that restoring $500 million in recurring state payments from the general fund is the same size the State is asking the City to pay.

18-B State “Matching Contributions Should Be Paid by State General Fund, and Adjusted for Inflation – Decades Long State Raid has Cost MTA Nearly $4 Billion

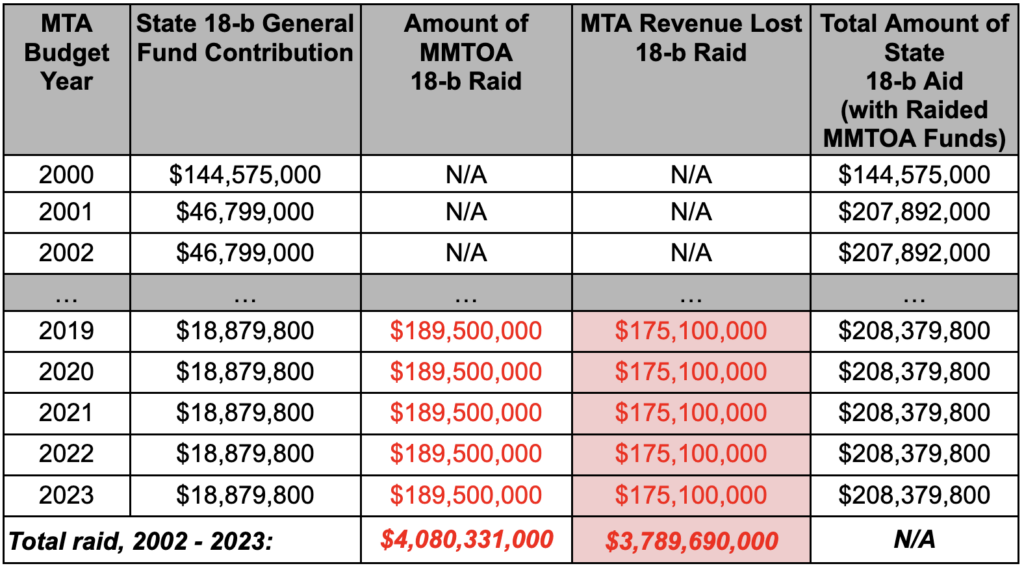

The State’s 18-b contributions have stayed flat for decades and essentially been an ongoing budget raid in which MTA’s dedicated funds have been diverted and relabeled by the Governor and Legislature as state transit matching funds. This has amounted to $175 million annually from the MMTOA fund for over twenty years to pay for its own contribution to the MTA. See the table below.1

As shown above, the State’s raid of MMTOA for its 18-b general fund contribution has totaled $4 billion since 2002. This means that over the last twenty years, the State has diverted a staggering $3.8 billion of promised revenue from the MTA, and $4 billion from all downstate transit systems.

The 18-b program has remained flat for decades, providing only $208 million to all transit systems each year since 2001. If it were to be adjusted for inflation, the program should be approximately $350 million a year statewide, with the MTA receiving $305 million (approx. 87%), or $125 million more annually. The 18-b program requires a 100% local match, so increasing the state amount would require an increased local contribution as well from New York City and the surrounding counties.

New York City Contributions

Under the Governor’s proposal, New York City contributions would come from student Metrocard and paratransit payments, as well as payments to offset exemptions to the Payroll Mobility Tax within the City.

We believe that New York State must pick up the full bill to offset the exemptions that it created in 2011 and 2015 to the PMT, rather than have the City pay $115 million toward PMT “make whole” payments. When the Legislature created the exemptions, the law promised losses would be “offset through alternative sources that will be included in the state budget.” The intent was clearly for the State to pay for the losses to MTA, not the City.

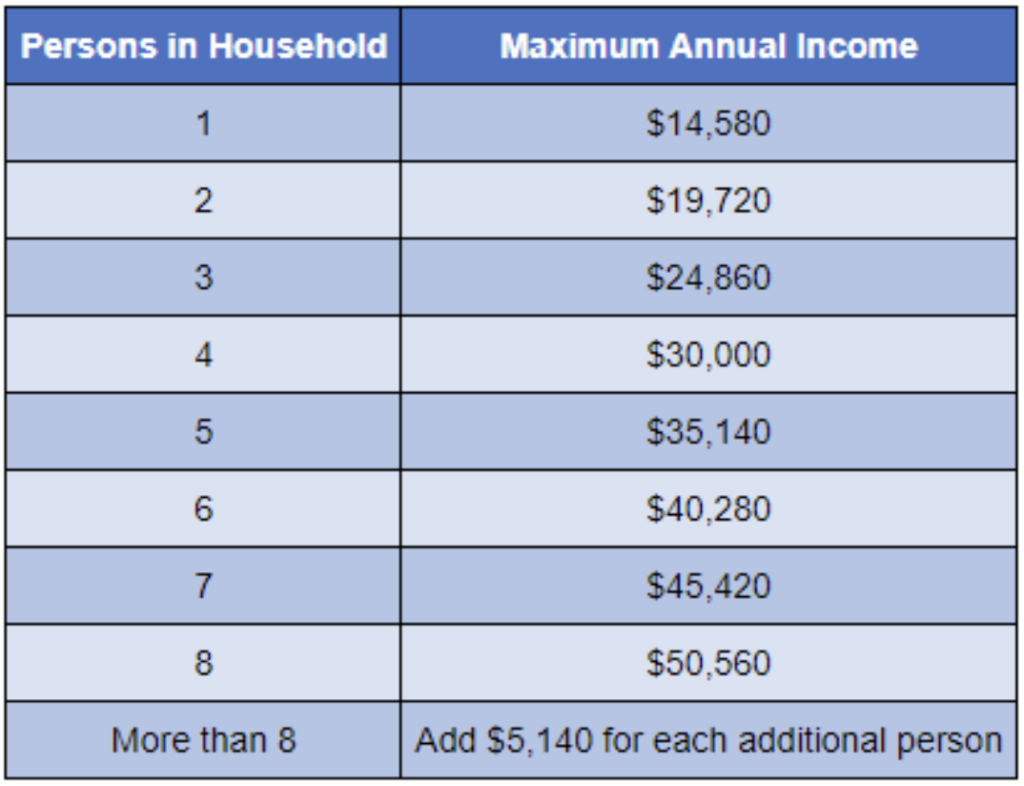

A better way for the Governor and Legislature to work with the City would be to push for expansion of the Fair Fares program. The Fair Fares program, funded by the New York City budget, currently caps out at very low income thresholds, which limits eligibility and therefore the pool of individuals who can opt into the program. See the chart below of the maximum income thresholds under the current Fair Fares program.

Groups such as Community Service Society have asked for the Fair Fares program to be more robustly funded in the New York City Budget, and for the eligibility threshold to be increased from 100 percent of the federal poverty level to 200 percent.

Footnotes

1 Information obtained from Office of the NYC Comptroller, William Thompson, “Putting the Brakes on Bus and Subway Fare.” August 2007. https://comptroller.nyc.gov/wp-content/uploads/documents/080707-MTA_revenue_options_rpt.pdf and MTA financial plans, 2002 to present, available at: https://new.mta.info/transparency/financial-information/financial-and-budget-statements