Gov. Cuomo’s New Budget Raids $145M in MTA Dedicated Funds on Top of $261M Taken in 2020

paid in the form of fare hikes

Governor Cuomo’s proposed Executive Budget would transfer approximately $145 million in MTA dedicated funds to the state’s general fund, as part of a $160 million total raid on statewide dedicated transit funds, as covered by the New York Daily News on February 11, 2021. See also the New York Daily News editorial on this issue, calling for raids on MTA dedicated funds to be stopped permanently. Raids of dedicated transit funds are a backdoor tax on MTA riders that the State Legislature must reject because riders may be forced to make up for this shortfall with a fare hike or service cuts.

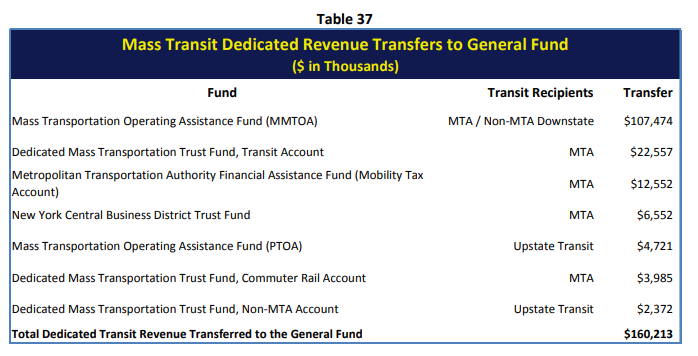

The Assembly’s “Yellow Book” analysis of the Executive Budget outlines $160 million in total raids of transit dedicated funds, from crucial funds like Metro Mass Transportation Operating Assistance Fund (MMTOA – $107 million) and the Central Business District Trust Fund (from Internet Sales Tax funds – $6.5 million), among others. A total of seven different statewide transit funds would be raided, which are appropriated through the budget process each year. See below a table from the Assembly’s report (see page 109 of the pdf).

The raids take place in the Article VII Public Protection and General Government Legislation (see page 197 of the pdf). They do not include a diversion impact statement, as required by the Lockbox Law passed by the Legislature in 2018. The diversion impact statement was intended to show how the raid would affect delivery of service.

The proposed fare and toll hikes for 2021 proposed by the MTA would raise $148 million for the MTA. The MTA in January announced that it would postpone the fare increases, which were budgeted to raise $89 million in 2021 for subways and buses, and $21 million for commuter rails. The state providing all dedicated funds that come in for 2022 would nearly equal the amounts that would be raised from fare and toll increases.

Withholdings from 2020 Still Not Repaid

The MTA has also had millions of dollars withheld in 2020 through the “budget adjustment process.” To date, the Division of the Budget has not provided a list of all withholdings from calendar year 2020 by agency. The Legislature has been notified of only 25% of all withholdings. The delay in payments of state dedicated funds was cited in a downgrade by Kroll, a ratings agency, which said: “The delay of funds is inconsistent with KBRA’s expectation of uninterrupted State support of MTA operations…the timely release of State appropriated funds is critically important.” MTA Chief Financial Officer Bob Foran said in response to press inquiries at the MTA’s January 21, 2021 Board meeting that the MTA adjusted its 2020 budget to account for a $261 million loss from state withholdings. The repayment of these funds could also help the MTA to close any remaining budget gaps for 2021.

In New York State are “dedicated taxes” really dedicated?

Dedicated taxes are created by the Legislature to fund a specific purpose or program and are categorically different from the state general fund. Dedicated transit taxes like those being raided by the Governor were created to support the operations of transit agencies in NY. Raiding dedicated transit funds breaks trust with the public, who pay these taxes with the understanding that they will fund transit service. The majority of MTA state dedicated taxes are paid for by NYC residents. MTA dedicated taxes have declined due to the COVID-19 pandemic, but are also being raided by the state for its general fund — a double hit to MTA riders.