Budget Testimony: Congestion Pricing Essential to MTA and NY’s Future

Testimony for Joint Legislative Hearing on Transportation

Congestion Pricing Remains Essential to MTA Capital Plan and New York’s Future

Reinvent Albany advocates for transparent and accountable government. We are presenting our thoughts on the transportation components of the FY 25 Executive Budget, in particular as it pertains to the MTA. Below is a summary of our positions on the proposals, as well as additional budget and legislative recommendations. Further analysis of capital spending and some of the budget proposals is provided in the full testimony.

Congestion Pricing is Essential to MTA Capital Plan and NYS Economy

Reinvent Albany strongly supports congestion pricing because it’s the law, and has been shown globally to reduce motor vehicle congestion, air pollution, and travel times, and will raise $15 billion to restore and improve transit.

- No new exemptions or credits should be added to the congestion pricing program beyond those proposed by the Traffic Mobility Review Board (TMRB) and approved by the MTA. The MTA has kept tolls, credits, and exemptions simple and easily understood by the public, which is particularly important during the start-up phase. A flat per-ride toll for app-based for-hire vehicles (Uber and Lyft) is good policy, and we support an even higher amount of $3 or more above the proposed $2.50. We strongly agree with the Environmental Assessment that the MTA must continually monitor how well congestion pricing is reducing traffic delays and generating revenue, and regularly modify the program so it achieves the best possible results – this can be done administratively, and does not require state legislation. A core part of this ongoing improvement is publishing traffic, air quality, and revenue data, as required by the MTA Open Data Act.

- Completion of the 2020-24 capital plan depends on congestion pricing. Congestion pricing represents the largest single source of funding for the capital plan at $15 billion or 27% of total funds.

- Nearly four years into the 2020-24 capital program, funding is coming in at the slowest pace of the last three capital programs. Only 28% has been received ($15.7 billion of the total $55 billion needed, largely from federal funds).

- Capital spending for the 2020-24 plan is historically slow due to COVID-19 impacts and lack of funding, primarily due to delays to congestion pricing.

- Congestion pricing’s benefits go well beyond the environment, helping communities throughout NYS.

- By law, revenues are distributed 10% to Long Island Rail Road, 10% to Metro-North Railroad, and 80% to New York City Transit, funding crucial state of good repair and ADA projects for the subways, buses, and commuter rails.

- MTA workers will get $3.2 billion of the $15 billion congestion pricing will raise in revenue (see our October 2023 analysis). The MTA’s capital plan reimburses the operating budget for the salaries of MTA employees – the majority of whom are represented by TWU Local 100 – who do in-house capital work.

- The MTA is big business in NYS, with more than $26 billion going to local companies throughout the state since 2014. See our fact sheets and maps of MTA spending on companies in each NYS Congressional, Senate, and Assembly district.

- Better toll enforcement will ensure integrity and fairness, and boost revenue collection as congestion pricing turns on.

- We support Parts C and D of TED Article VII to give the MTA more tools to combat toll evasion and exemption fraud, and enable collection of $200-$400 million more in revenues annually that are currently lost.

- The Legislature should use the Outer Borough Transit Fund to improve bus, subway, and commuter rail service rather than provide toll discounts. We note that outlays from this program, first approved in the FY 2019 budget, have been newly announced this year. The Legislature should be looking at ways to bring riders back and boost mass transit service in transit deserts, rather than encourage more driving as congestion pricing is turning on this year.

- To build public support, the MTA should connect the dots between congestion pricing and the specific projects it funds. We continue to support full implementation of S3545 (Ramos) / A4043 (Carroll), which requires additional transparency of spending on MTA capital projects, including that the capital dashboard provide sources of funding for individual projects. Portions of this bill were passed in last year’s budget; the MTA has since created specific tabs for ADA and resiliency projects on its dashboard.

- Similarly, we support Tri-State Transportation Campaign’s request for open data on the NYS Department of Transportation’s 2022-2027 capital plan. The project list should be released on data.ny.gov pursuant to Executive Order 95 of 2013, and the DOT’s stated commitment to transparency in their 2021 Transparency Plan.

Operating Aid to MTA

- $7.9B in total state operating aid ($4.2 billion appropriated and $3.7 billion remitted directly to the MTA) is good news for MTA riders, because it will keep the MTA solvent and continue to fill budget gaps this year.

- We caution, however, that casino revenues promised to the MTA in last year’s budget ($1.5 billion in licensing fees and $213-$413 million in annual tax revenues) are at risk to not come in 2026 as planned. See Citizens Budget Commission’s analysis, as well as the MTA’s November 2023 Financial Plan Presentation, which shows a potential $500 million annual shortfall.

- The Payroll Mobility Tax (PMT) correction (Revenue Budget Part C) should go much further to include suburban counties in the full tax. The Governor’s budget has a correction for the PMT to apply to self-employed individuals in suburban counties. However, we continue to believe it was a mistake to omit the suburbs from the PMT increase in last year’s budget. Employers outside of New York City in the MTA region are part of the same regional economy that depends on a healthy MTA, and have a shared responsibility with all MTA stakeholders to make the MTA whole. NYC taxpayers already pay an outsized amount of taxes to the MTA, according to Citizens Budget Commission research.

- The Legislature should remit more MTA dedicated funds, such as the Internet Sales Tax, directly to the MTA to protect them from raids by the Executive by passing S1205A (Gounardes) / A2895 (González-Rojas).

Additional Article VII Proposals (TED)

Strong Support for Sammy’s Law

- Part I – Allow New York City to Lower Its Speed Limit. Reinvent Albany supports Sammy’s Law, S2422 (Hoylman-Sigal), and its inclusion in the budget to grant New York City greater authority over its speed limits. However, we believe that NYC should have full discretion to set its own speed limits and develop its own traffic enforcement programs, rather than continue to be dependent on Albany changing or extending these laws.

Partial Support

- Part B – MTA Fare Enforcement. We take no position on increasing fines for violations of New York City Transit Rules, but support efforts to use the Transit Adjudication Bureau for fare enforcement throughout the MTA system. It is not equitable to have different fare enforcement standards on the buses and subways vs. the commuter railroads. Additionally, efforts to forgive fare evasion fines for those eligible for Fair Fares are sensible to reduce the adverse effects of enforcement on those least able to afford the fare, as well as increase awareness of the Fair Fares program.

Legislature Should Hold a Hearing on MTA Value Capture, as Promised

- Part A – MTA Tax Increment Financing (TIF). The Legislature should hold a joint hearing on MTA tax increment financing and value capture, as it stated it intended to in the FY 2022-2023 budget, prior to extending this program. A hearing would allow the Legislature to understand potential use cases for and risks inherent to such financing schemes, and learn more from national experts about how value capture has worked elsewhere. There are a number of experts on TIFs, including the Citizens Budget Commission, Good Jobs First, Bridget Fisher (formerly of the New School), Eric Kober of the Manhattan Institute, and Rachel Weber at the University of Illinois – Chicago, who could be invited to the hearing (see our blog post on TIFs for more information about these scholars).

Given the opaque manner in which the Penn Station redevelopment project was approved, we continue to have a number of concerns about the proposed extension of the TIF allowance under the General Municipal Law Section 119-R. We note that this mechanism has not yet been used – the Penn project is proceeding under the Urban Development Corporation law. Therefore there is no clear use case for the project that has been publicly discussed.

There are three separate value capture mechanisms to be extended in the budget:

- Tax increment financing: “the allocation of an increment of property tax revenues in excess of the amount levied at the time prior to planning of a mass transportation capital project.”

- Special transportation assessments: “imposed upon benefited real property in proportion to the benefit received by such property from a mass transportation capital project, which shall not constitute a tax.”

- Land value taxation: “the allocation of an increment of tax revenues gained from levying taxes on the assessed value of taxable land at a higher rate than the improvements, as defined in subdivision twelve of section one hundred two of the real property tax law.”

These mechanisms can be combined, and local governments may “conditionally or unconditionally grant or pledge a portion of its revenues allocated” under the law. This means that PILOT payments could be discounted in the form of subsidies to developers. Reinvent Albany does not oppose capturing any of the increased value that is generated from transit improvements to fund those mass transit projects. However, it must be done transparently and the public should fully understand all the assumptions that are being made and the impact on local government tax revenues.

We note that legislation to be introduced last year by Senator Comrie and Assemblymember Mamdani as part of the Fix the MTA package would add transparency requirements to assessment and land value taxation capture mechanisms, while eliminating the allowance for Tax Increment Financing. New York’s TIF law is a national outlier in that it includes zero transparency or reporting requirements, instead essentially giving a blank check to provide overly generous tax breaks to developers with no accountability. See our blog post on TIFs for more information.

MTA Capital Funding and Spending

Historically, transit advocacy has centered on finding funds, but Reinvent Albany has looked at actual expenses – not “commitments” as the MTA does. Commitments begin the time when a contract is signed, or the MTA intends to use employees to complete a project. This is not the same as actual spending on employees or paying a contractor. Commitments are the first step in a lengthy process, expenditures the last.

MTA Capital Spending

Capital plan spending for the 2020-2024 plan has been sluggish, with only 10% or $5.6 billion spent out of the $55 billion plan. This has been due to factors including COVID-19, as well as delays to congestion pricing. These challenges have exacerbated the MTA’s existing difficulty to spend capital dollars quickly. The 2015-2019 program, for example, totals nearly $34 billion and 88% has been spent to date, as of data through June 30, 2023.

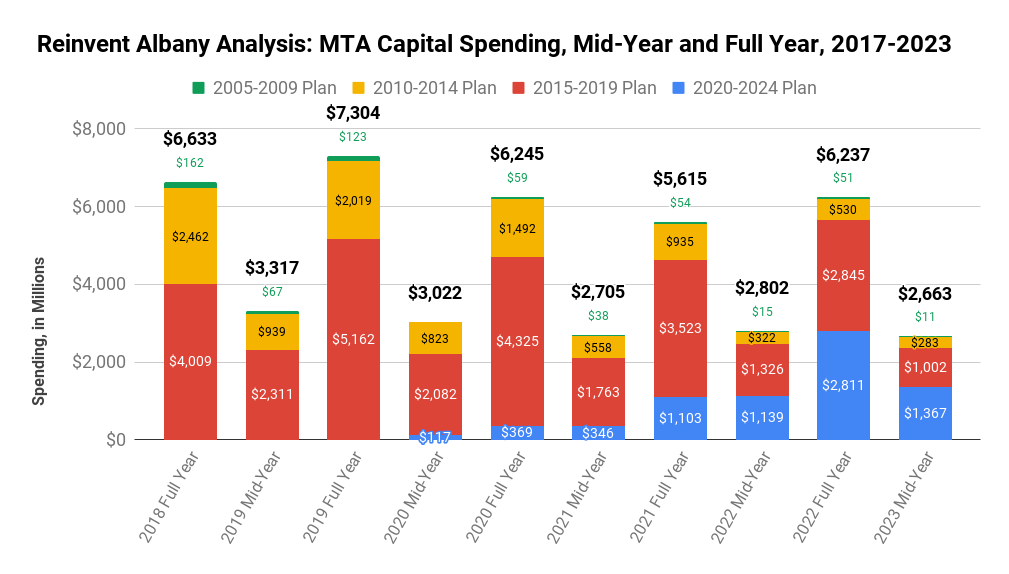

As seen below, the MTA was able to pick up the pace of its capital spending in 2019, spending $7.3 billion on all capital plans, but those gains were eroded during COVID. The MTA still has not caught up to the 2019 spending levels, spending only $6.2 billion in 2022. Note that the chart below has not been adjusted for inflation – this would show an even larger gap in spending. The lack of congestion pricing funds, which were anticipated to start arriving in 2021, is likely a factor of the slower pace because fewer dollars are available. As previously noted, spending is different from the commitment of funding, and a better gauge of how much of each capital plan has been completed.

Receipt of 2020-2024 Capital Plan Funding

There is no new capital funding for the MTA in the budget this year, only reappropriations for the 2015-2019 and 2020-2024 capital plans. According to the latest MTA documents, state capital funds are still due for the last two capital plans, though 90% of the 2015-2019 state capital dollars have been received. Funds received by the MTA for each of its capital plans is below (in millions):

Congestion pricing remains urgent given the slow pace of funding and capital spending on the 2020-2024 capital program. Congestion pricing is the single largest funding source for the 2020-2024 capital program at $15 billion, and the MTA originally planned on this funding arriving in January 2021. The vast majority of funds received through November 30, 2023 for the 2020-2024 program have come from the federal government ($8.7 billion of the $15.7 billion, or 55% of all receipts). The City of New York has provided $2.7 billion in capital funding, with the state providing $511 million.

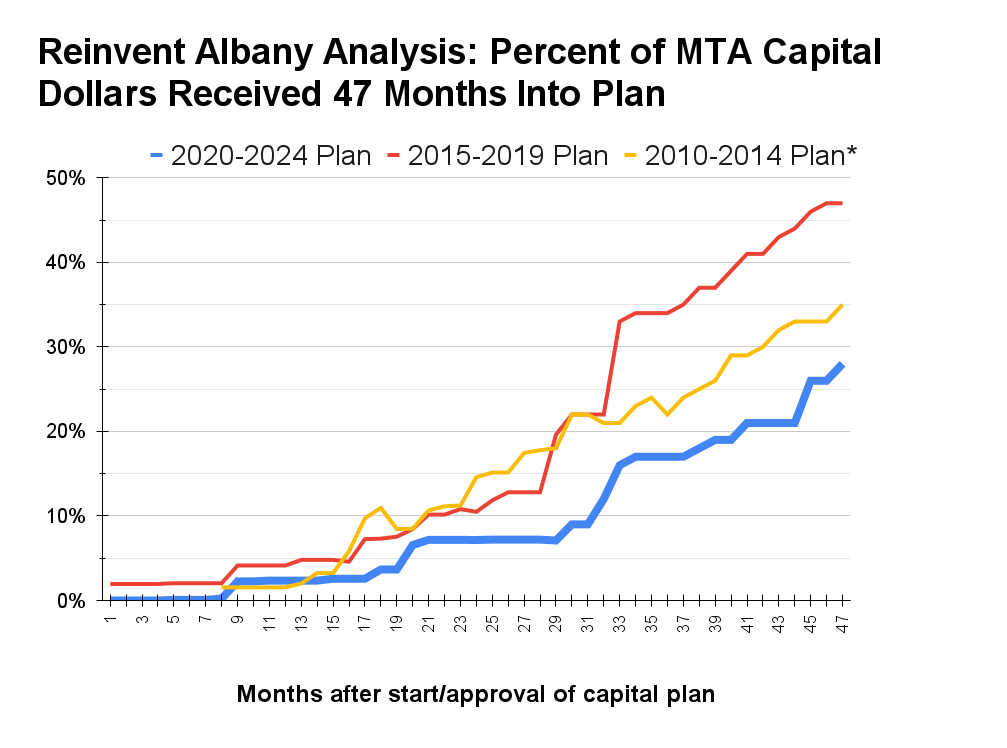

The 2020-2024 plan dollars have come in at the slowest pace compared to the past two capital plans, when looking at the total percentage of funding that has been received in the first four years of each plan. In the chart on the next page, we update our analysis from August 2021, MTA Needs Congestion Pricing Money Now, Not in 2023, with data through November 30, 2023. The 2020-2024 plan has received $15.7 billion (28%) nearly four years in, compared to $15.7 billion (48%) for the 2015-2019 plan and $12.1 billion (35%) for the 2010-2014 plan at this juncture. Overall, the 2020-2024 plan is the biggest by far at $55 billion rather than $34 billion and $32 billion, respectively.

The MTA has only 28% of the funds needed to fund the 2020-2024 program as of November 2023, showing the urgent need for congestion pricing revenues.

Thank you for your consideration. If you have any questions, please contact Rachael Fauss, Senior Policy Advisor, at rachael [at] reinventalbany [dot] org.