New Report: Investing in the MTA Is Investing in America

Introduction: Analysis of MTA Spending on Vendors 2011-2024

The Metropolitan Transportation Authority (MTA) is one of the largest state government agencies in the United States. The MTA’s operating budget totals $20 billion in 2025, and its 2025-2029 capital program amounts to $68 billion. The MTA’s budgets dwarf those of many states – including Vermont, Rhode Island, Maine, New Hampshire, North Dakota, South Dakota, Idaho, and Montana – each of which had $15 billion or less in combined annual operating and capital expenditures in 2024. The MTA carries about 40% of transit trips nationally, which supports economic prosperity in the region and the US economy – the New York metropolitan region’s share of US GDP was 8% in 2023.

As the nation’s largest domestic mass transit provider, the MTA purchases a huge array of goods and services from across the US. This spending supports the MTA having a daily ridership of up to 4 million – a population bigger than that of 22 states – on its subways during peak travel times. The MTA employs over 70,000 workers who service more than 6,500 subway cars, 472 subway stations, 665 miles of track, and nearly 6,000 buses, all of which require substantial investment.

Given its sheer size, the MTA’s contributions to the economy of the New York City metro area – and the US as a whole – are vast. Public transit is the lifeblood of the region; it powers the local economy and enables NYC’s growth and success. But what is less known is the value it brings to the rest of the country: From 2011 to 2024, the MTA spent $19 billion across 46 states outside of New York, supporting as many as 247,000 jobs in politically blue, red, and purple states alike, as described later in this report.

It makes sense that blue states with large urban transit systems have large transit-related industries that the MTA patronizes. But taken together, the 4 red states where the MTA does substantial business see greater MTA spending than either California or Illinois alone (North Carolina, Ohio, South Carolina, and Texas). In total, companies in red states by U.S. Senate representation received more than $3.5 billion in MTA payments over fourteen years. States that voted for Trump in 2024 received nearly $7 billion from the MTA over this period.

This report makes clear that threats from the federal government to cut transit funding for New York and block congestion pricing would only serve to limit the amount the MTA can spend in support of its mission, causing harm to businesses across the country that are paid by the MTA for goods and services.

The MTA’s spending reaches far and wide, with wooden railroad ties from West Virginia, tracks from Ohio, uniforms from South Carolina, software from California, Dell computers from Texas, HP copiers from Arkansas, police dogs from Alabama, and railcars, buses, and parts from Indiana, New Mexico, Minnesota, and Pennsylvania, among many other goods and services. See below for a map of the MTA’s spending across the country from 2011 to 2024.

The MTA Creates Jobs Across the United States

Job creation as a result of MTA capital spending in New York State has been repeatedly studied. The Partnership for New York City analyzed the MTA’s $55 billion 2020-2024 Capital Plan, projecting that 7,300 direct, indirect, and induced full- and part-time jobs would be created in NYS for each $1 billion of direct spending in the state. The MTA has said that its 2020-2024 capital plan would create 57,400 jobs in NYS.

The Partnership for New York City also reviewed the job impacts of the MTA’s proposed $68 billion 2025-2029 Capital Plan, projecting that 5,900 direct, indirect and induced jobs will be created per year in NYS for each $1 billion of direct spending in NYS. Given the rates of inflation, it is not surprising that the total number of jobs per billion has decreased. In total, 363,700 job-years (direct, indirect, and induced jobs lasting one year each) would be created under the 2025-2029 plan in New York State going forward, according to the Partnership for New York City.

The American Public Transportation Association (APTA) estimates the value-add of transportation investment as even higher, after incorporating the importance of public transit in supporting the economy by getting transit riders to work and school. From APTA’s most recent statistics:

- Every $1 invested in public transportation generates $5 in increased GDP over 20 years.

- Every $10 million in capital investment in public transportation yields $26 million in increased business sales.

- Every $10 million in operating investment yields $30 million in increased business sales.

The federal government has also measured national job creation as a result of its highway and transit investments. The Council of Economic Advisors in 2011 estimated that every $1 billion of highway and transit investment from the American Jobs Act would support 13,000 jobs – direct, indirect, and induced – for one year.

Based on these federal job creation figures of $1 billion in spending supporting 13,000 jobs for one year, Reinvent Albany estimates that MTA spending of nearly $19 billion in states outside of NY may have supported as many as 247,000 direct, indirect, and induced jobs lasting one year each from 2011 to 2024.

MTA Spending in the United States

The MTA spent a total of $60.5 billion in the United States on outside vendors from 2011 to 2024, according to a Reinvent Albany analysis of procurement data from the MTA’s open data and the New York’s Authorities Budget Office, which oversees New York’s public authorities. Not surprisingly, most was spent in New York State – $41 billion, or just over two-thirds of total MTA spending. This report does not detail spending in New York; see our most recent analysis of MTA spending in the tristate area from February 2025, which breaks down spending by political districts. The top 15 states by MTA spending from 2011 to 2024 were:

- New York, $41B

- New Jersey, $5B

- Pennsylvania, $3B

- Illinois, $1.9B

- California, $1.7B

- Minnesota, $734M

- North Carolina, $716M

- Connecticut, $714M

- Ohio, $662M

- Maryland, $574M

- South Carolina, $531M

- Massachusetts, $463M

- Virginia, $461M

- Texas, $344M

- Alabama, $268M

Only three states had no MTA spending from 2011 to 2024: Alaska, Hawaii, and Wyoming.

To establish these numbers, Reinvent Albany relied on vendor address information provided by the MTA. Some companies have multiple locations, and the address provided may reflect a headquarters but not the entire base of its operations or staffing. The payments were made from 2011 to 2024, so may also reflect operations that have since moved or closed.

A full list of spending in each state is provided in Appendix 1.

Spending by Region/State

Looking at the vast amount of MTA spending from 2011 to 2024 reveals some interesting trends and noteworthy purchases across US regions. State listings include ranking by amount of MTA spending.

- Nearby states saw the most MTA spending:

- New Jersey (#2, $5B) had a number of large construction firms like Walsh Construction ($393M) and Schiavone Construction ($137.5M) that operated such joint ventures as the 86th Street Constructors Joint Venture ($229.2M).

- Pennsylvania (#3, $3B) provided crucial transit equipment from major multinational firms: Bombardier ($362.3M) for railcars; Mitsubishi Electrical Power Products ($211.4M) for signals; Hitachi Rail STS ($145M) for rail parts and switches; Thales ($114.9M) for signal systems; Ansaldo STS USA ($97M) for train control and signal systems; and Cubic ($94.6M) for fare payment systems.

- Connecticut (#8, $714M) provided construction and equipment support from Ducci Electrical Contractors ($107M); Banton Construction ($75.6M); and Sperry Rail ($37.4M).

- Midwestern states with large steel and manufacturing histories landed big MTA contracts:

- Illinois (#4, $1.9B) companies included Siemens ($482.2M) providing train control systems and Prevost Car ($343.7M) providing buses and parts.

- Minnesota (#6, $734M) provided buses from its New Flyer ($328M) Crookston plant, and Accenture ($172.7M) provided IT services.

- Ohio (#9, $662M)’s location of New Flyer ($160.5M) provided bus parts, and Cleveland Track Material ($71.4M) provided tracks and parts.

- Indiana (#21, $128M) provided bus parts from Muncie Transit Supply (acquired by ABC Companies, $80M) and routers from Core BTS ($7.8M).

- Appalachia provided wood railroad ties and other goods and services for the MTA:

- Kentucky (#23, $78M) provided bus parts from MCI Service Parts ($44.4M), and Koni America ($2.4M) provided shocks.

- Tennessee (#27, $65.5M) had Republic Parking System provide legal support ($28.4M), and Cherokee Porcelain Enamel ($1.4M) made specialty signage for the MTA.

- West Virginia (#32, $45M) is home to Appalachian Timber Services ($44.4M), which landed large contracts with the MTA for wooden railroad ties.

- The Carolinas’ top vendors provided rail parts and services, as well as call centers:

- North Carolina (#7, $716M) company Global Contact Services ($395.1M) served as the MTA’s paratransit call center, and Railroad Friction Products ($41.4M) sold brake pads to the MTA.

- South Carolina (#11, $531M) provided railcar parts from Wabtec ($211.1M) and Harsco Rail ($161.9M).

- Other Southern states have leading rail suppliers and have supported other crucial MTA operations:

- Alabama (#15, $268M) provided rail parts and services from Voestalpine Nortrak ($126.9M) and Progress Rail ($117.6M).

- Florida (#18, $210M) companies included Vehicle Maintenance Program ($37.6M), which sold the MTA bus parts, Palm Coast Data ($28.1M), which assisted with MetroCard fulfillment, and UTC Fire And Security Americas Corp, which provided bus cameras ($24.2M).

- Louisiana (#36, $11M) saw Penta ($10M) provide communications/radio equipment and Southland Printing ($1.6M) print tickets for the MTA.

- Southwestern states provided a range of products and services, from software to buses:

- Texas (#14, $344M) has major corporate offices like JP Morgan Chase ($59.8M) and Dell ($43.3M); Telvent ($40M) repaired MTA toll registry systems.

- New Mexico (#22, $82M) has only one MTA vendor, Prevost Car, which landed a large contract for buses and parts for its Roswell location.

- Arizona (#33, $41M) company Axon Enterprise ($16.1M) provided body-worn cameras and Tasers to the MTA Police, and Trapeze Software Group ($10.3M) provided travel software.

- New England provided the MTA with a variety of services:

- Massachusetts (#12, $463M) saw Kronos (now UKG, $56.7M) provide employee timekeeping devices and software, and Staples ($32.9M), headquartered in Framingham, sold office supplies to the MTA.

- Maine (#26, $70M) provided the MTA with fuel cards for its fleets from Wright Express, headquartered in Portland ($61.3M).

- Rhode Island (#28, $65M) provided HVAC equipment from Walco Electric ($15.3M).

- Mid-Atlantic states provided significant engineering services and railroad materials:

- Maryland (#10, $574M) companies Knorr Brake ($384.9M) and Yangtze Railroad Materials ($37.6M) provided rail supplies, and ARINC (now under Wabtec, $55.6M) sold the MTA communications and control systems.

- Virginia (#13, $398M) had L3Harris Technologies ($54M) supply upgraded MTA Police radios, asset management services were provided from CSC Consulting ($50M), and ballasts and other parts were purchased from Plasser American ($43M).

- West Coast states had a number of large software and IT contracts:

- California (#5, $1.6B) provided tech support from Cubic ($458.8M), which is installing OMNY, and Oracle ($105M). The state also has a major office for MV Transportation ($796M), which provides paratransit service to the MTA.

- Washington(#20, $131M) state’s Stratagen Systems ($42M) provided paratransit scheduling software.

Major and Niche Industry Sectors

IT and Specialized Electronics Equipment

- Computer and IT equipment purchases were often made through large corporations headquartered out of state:

- Dell Marketing ($43M) in Dallas, Texas.

- Hewlett Packard ($27M) in Conway, Arkansas.

- IBM ($172M) in North Carolina.

- Specialized electronic equipment came from such vendors as Daktronics ($6.3M) in South Dakota, which makes LED displays.

Uniforms

- Uniforms and apparel came from states with a history of textile manufacturing:

- North Carolina provided the MTA with work boots from Safgard Safety Shoe ($21M).

- South Carolina provided uniforms from Seventh Avenue Trade Apparel ($2.7M).

Heavy Duty Equipment

- A number of states provided the MTA with construction vehicles:

- North Dakota is the site of the headquarters for Bobcat Excavators ($635.2k).

- Kentucky’s North American Equipment Sales ($5.8M) sells excavators.

- Minnesota’s Aspen Equipment sells Boom Trucks (cherry pickers) to the MTA ($6.9M).

K-9s

- Canines for the MTA Police Department came from out of state, and even beyond the tristate area – from as far as Alabama, Connecticut,Georgia, Illinois, Kentucky, Pennsylvania, Virginia, Tennessee, and Texas.

- One of Alabama’s top 10 MTA vendors is Alabama Canine Law Enforcement Officers, which sold the MTA $70k worth of police dogs.

- Other providers of MTA K-9s include Cobra Canine in Virginia and Tennessee, Shallow Creek Kennels in Pennsylvania, Worldwide Canine in Texas, and Integrated K9 Solutions in Georgia.

- Other K-9s are provided more locally by Connecticut K-9 Services.

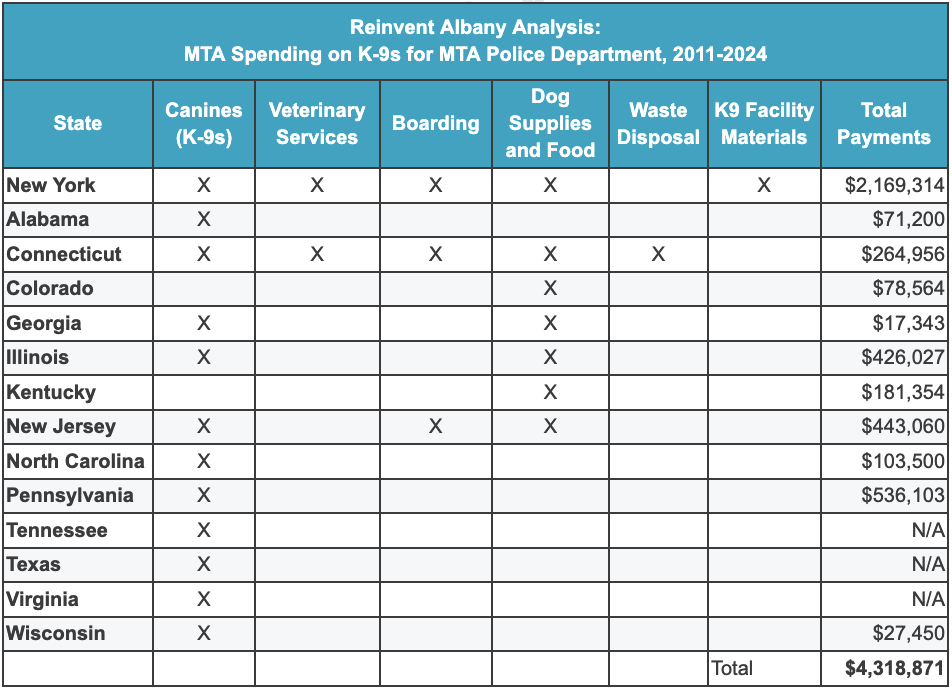

Below is a summary of the MTA’s spending of $4.3 million in 14 different states in support of its K-9 (police dog) unit. Canines were provided from companies in 14 different states, with supplies and dog food provided from an additional two states. While this spending is relatively small in the context of a $20 billion operating budget, it helps to illustrate how the MTA receives goods and services from a variety of states.

“N/A” indicates that contracts were recorded with MTA in the procurement data, but no payments were made from 2011-2024.

Appendix 1 – Total Spent by MTA on Vendors By State, 2011-2024

Click here or below to view the report as a PDF.

Click here to view the data.