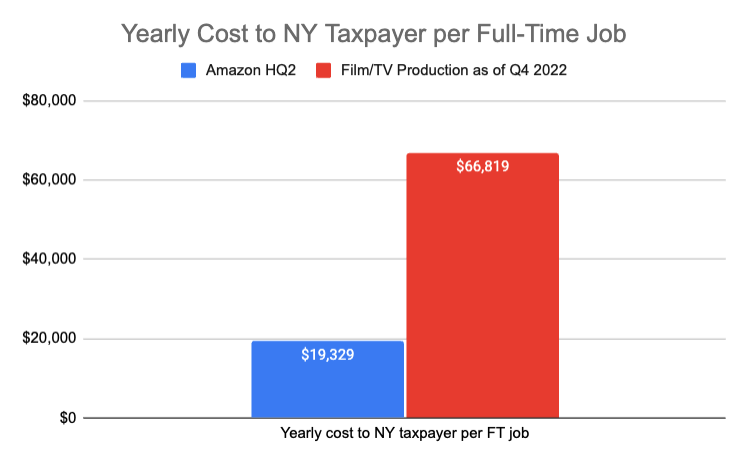

Each Film/TV Job Costs NY Taxpayers 3x More Than Failed Amazon HQ2 Job

Film/TV Job = $66,819/year

Amazon HQ2 Job = $19,329/year

A new analysis of government data by watchdog group Reinvent Albany found that each full-time film/TV production job currently costs New York State taxpayers $66,819 per year, compared to the $19,329 taxpayers would have paid for each job at Amazon’s failed second headquarters (HQ2) in Long Island City, Queens.

The costly Amazon HQ2 deal was rightly blasted by critics as a massive corporate giveaway. Yet, despite each film/TV job costing 3x more than an HQ2 job, some of these same critics are about to vote for a state budget that includes a 11-year handout from NY taxpayers to Hollywood producers costing a total of $7.7 billion.

New Findings

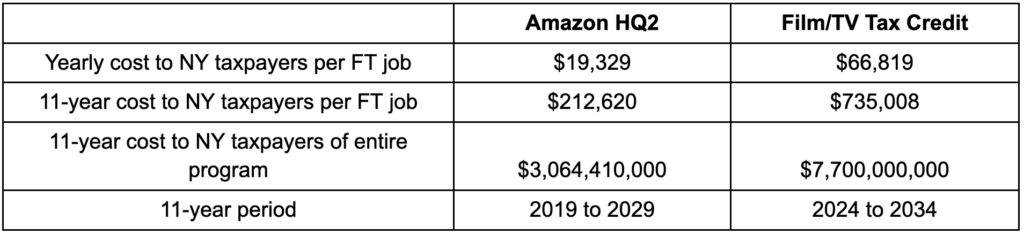

Film/TV tax credit = $7.7 billion over 11 years to film/TV producers from NY taxpayers (Governor SFY 2024.)

The FY24 budget proposal would add five additional years (SFY 2030, 31, 32, 33, 34) to the existing six-year program (SFY2024, 2025, 2026, 2027, 2028, 2029), as well as increase the amount from $420 million/year to $700 million/year for all years.

Current taxpayer cost per film/TV job:

- $66,819 per full-time job per year, or $735,008 per job over 11 years. (2024-2034)

- (Currently, the film/TV tax credit totals $420 million per year.)

Under the Amazon HQ2 deal:

- New York State and New York City taxpayers would have provided $19,329 per full-time job per year, for a total of $212,620 over 11 years. (2019-2029)

Tax Credit = Taxpayer Reimbursement of Production Expenses

New York’s film and TV tax credit program is actually a taxpayer reimbursement for 30% of the eligible costs (mainly personnel) incurred by an individual or corporate producer. The reimbursement is sent in the form of a tax refund to the individual or corporate producer and is based solely on reported production expenses. The taxpayer reimbursement is provided regardless of whether a production is profitable or a bomb.

Note that the reimbursement is treated as a tax refund, similar to what people commonly get for overpaying or withholding taxes. The actual money for the refund/credit going to producers comes out of a tax revenue account before that revenue is sent to the General Fund. Because the taxpayer reimbursement/tax credit to producers never goes through a budget appropriation, it is not counted as an expense in the state budget and therefore appears on the state ledgers as “free money.”

Film/TV Methodology (using Empire State Development Q4 2022 data)

- Full-time job equivalents = reported hours/2,080 hours

- Taxpayer cost per hour = dollars paid by NYS/credit eligible hours

- Taxpayer cost per full-time job = dollars paid by NYS/number of FTE job

- 11-year taxpayer cost per full-time job = yearly taxpayer cost/full-time job x life of the film/TV program (11 years)

See New Data: Giant NY Taxpayer Handout for Each Film/TV Job, March 7, 2023, Reinvent Albany.

Amazon HQ2 Methodology (see Breaking Down the Amazon Deal, November 21, 2018, Citizens Budget Commission)

- Yearly cost to taxpayers per full-time job = average of net new job commitments, cumulative for 2019-2029 divided by average of maximum total NYS + NYC benefits to Amazon for 2019-2029

- Total cost to NY taxpayers per full-time job = sum of maximum total NYS + NYC benefits to Amazon from 2019-2029 divided by net new job commitments by 2029

- Total cost to NYC taxpayers includes the first 11 years of Relocation and Employment Assistance Program (REAP) benefits, the Industrial and Commercial Abatement Program (ICAP) benefits (an 11-year benefit), and a one-time capital investment of $180 million (REAP and ICAP are NYC tax abatements).