Taxpayers Should Not Subsidize Large Contributions in Public Financing System

Public Financing Commission Must Further Lower Contribution Limits for Candidates

Large Contributions Should Not Be Subsidized With Taxpayer Money

Reinvent Albany called on the Public Financing and Elections Commission to further lower candidate contribution limits in a letter sent to its members today. The Commission discussed significantly lowering contribution limits in a public meeting on October 14th, but the proposed reductions are not low enough.

Low contribution limits are particularly important, because the Commission’s proposed public financing program will provide public funds for the first portion of ANY eligible contribution, not just small contributions. Taxpayers should not subsidize contributions as large as $12,000 for the election cycle with as much as $3,000 in public money.

Reinvent Albany believes contribution limits should be no higher than $2,800 per election, which is the limit for the Presidency of the United States. There is no reason why any candidate running for office in New York State should need to raise more funds than presidential candidates. We oppose providing public funds for the first portion of large contributions, and believe only small ones should be matched. Reinvent Albany previously called on the Commission to only match small contribution instead of the first portion of any eligible contribution in our comprehensive recommendations.

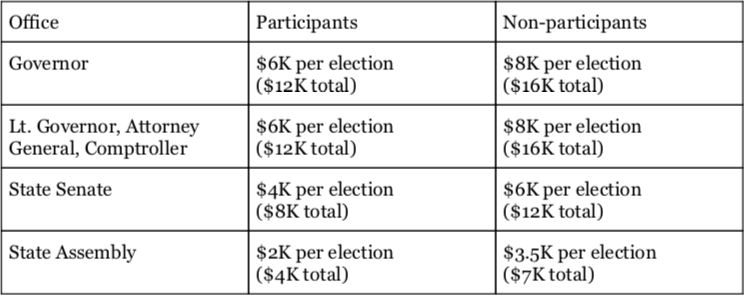

The Commission discussed at its meeting lowering contribution limits significantly from the existing limits for both candidates who opt into the public financing system, and those who do not. The Commission proposed the limits below:

While the proposed contribution limits are substantially lower than existing limits, we think they should be even lower. The Commission’s proposed lower limits are well above the maximum limits for the Presidency of the United States and members of Congress ($2,800 per election, total $5,600), and most other states. The maximum contribution for citywide offices in New York City is $2,000 for participants and $5,100 for nonparticipants for the election cycle.

Reinvent Albany is deeply concerned by the prospect of matching very large contributions with public money. Under the proposed public financing system, the first $250 of a contribution will be matched by as much as $8:$1 in public money for every $1 in private money. This means a donor giving $12,000 to candidates for governor for the election cycle ($6,000 per election) will have their contribution matched with $3,000 ($1,500 per election) in public funds. A State Senate candidate receiving the maximum of $8,000 for the election cycle from a donor would also receive $3,000 in taxpayer money.

New Yorkers will rightly wonder why they are subsidizing such large contributions.

New York City significantly lowered its contribution limits in 2019 because candidates – particularly incumbents and mayoral candidates – were raising funds from larger contributions and receiving public funds. The 2013 mayoral candidates raised about half their funds from the maximum contribution of $4,950, and 95 percent of the funds raised were from contributions above the matchable amount ($175). We believe the result would be even more pronounced for candidates for statewide office under the Commission’s proposed contribution limits. Similarly, Reinvent Albany found that incumbent Councilmembers during the 2017 election raised 59 percent of their funds from contributions of $1,000 or more and 91 percent of their funds raised were from contributions above the matchable amount ($175) even with a contribution limit of $2,850.

We have proposed a variety of ways to address large contributions in our comprehensive recommendations in the context of a public matching program, including only matching small contributions and lowering dramatically contribution limits but raising them in the face of large independent expenditures. Presuming the Commission has decided not to act on our previous recommendations, the Commission should simply lower their proposed contribution limits further.

-30-