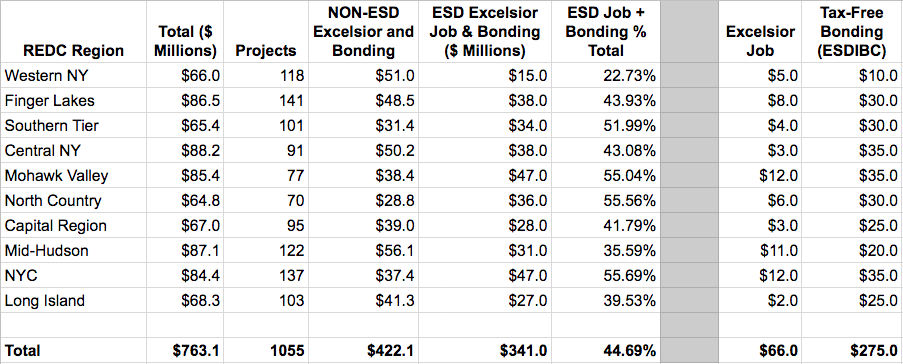

Analysis: Just Over Half of NYS REDC Awards Are Actual State Grants Versus Potential Tax Abatements, Tax-Free Bond Borrowing

Yesterday, Lieutenant Governor Kathy Hochul announced $763.1m in State funding awarded through the 2018 Regional Economic Development Council process. Of this, $422m is direct state grants to localities, non-profits and businesses were announced. (About $21 per New Yorker.) The State’s ten REDCs are essentially a publicity framework for the governor to award dozens of small and large batches of state funding from very diverse sources in a game show format. The REDCs are strictly advisory and state agencies make the final determination. The REDC awards are a big deal Upstate, especially in small towns, but get little notice in NYC because NYC projects were awarded a total of roughly ten dollars per resident, which isn’t much. Really, the REDC awards are small potatoes in the scheme of the immensity of NY government. For instance, the MTA’s $16.6B operating budget is 22x larger than REDC funding.

The confusing thing about the REDC process is that it blurs together traditional state aid to local government for things like clean water with “economic development” grants to businesses. So, some of those seeking funding are local governments, some are non-profits and some are businesses. One interesting thing we noticed is that almost half of REDC spending, 45%, is in the form of Excelsior Job Credits and Tax-Free Bonds (ESDIBC) that the state allows local Industrial Development Authorities to issue for economic development, infrastructure and community revitalization.