Watchdog Testimony on East Side Access: What is the post-COVID operating deficit and does the MTA need another subsidiary?

for State Senate Committees on Transportation and

Corporations, Authorities & Commissions

Oversight Hearing on East Side Access and East River Tunnels

Re: How big is the ESA’s post-COVID operating deficit, why do the MTA and people of New York need yet another public authority subsidiary, and can the MTA afford expansion projects?

Good morning, Chairs Comrie and Kennedy, and other members of the Senate. I am Rachael Fauss, Senior Research Analyst for Reinvent Albany. We advocate for more transparent and accountable state government — including for state authorities like the Metropolitan Transportation Authority (MTA).

Thank you for holding this hearing today on East Side Access (ESA) and the East River tunnels. We appreciate Senate oversight of this massive, $11B expansion project. While the reasons for delays and cost overruns on the project have been the subject of numerous policy reports and news stories, we want to focus today on broader themes of accountability and transparency regarding East Side Access operating costs, MTA capital projects, and provide an updated analysis of the rate of MTA capital spending. Understanding the MTA’s capacity to spend capital dollars is important for assessing how $11B+ mega-projects like East Side Access create opportunity costs for other projects. We will also provide specific commentary on concerns regarding creation of a new subsidiary to manage East Side Access terminal maintenance.

To summarize our testimony and findings/recommendations:

- The Legislature must ask for detailed information about operating costs and service plans for East Side Access to better understand the return on investment and operating challenges facing the Long Island Railroad and MTA as a whole. State Comptroller Thomas DiNapoli said in September 2019 that ESA has contributed to the MTA’s structural imbalance in its budget, and the cost of operations and maintenance were projected to reach $205M while only increasing fare revenue by $14M in 2023 – a $191M operating deficit. The MTA in its August 2020 doomsday plan said delaying revenue service for ESA could save $250M. The Legislature should seek updated numbers to better understand the cost of running the new service given the continuing impact of COVID-19.

- The Legislature should encourage the MTA to to boost use of the commuter railroads within NYC, and publicly release Outer Borough Fund projects and/or recipients, if final, as requested by advocates in 2019.

- The Legislature must seek a detailed, public rationale for creation of a new MTA subsidiary to oversee ESA terminal and track maintenance given concerns about shifting the cost burden off of LIRR, greater opacity of multiple agency budgets, and the general proliferation of public authority subsidies in NYS. To that end, the Legislature should pass S5137 (Mattera)/A4078 (Colton) to require legislative approval of public authority subsidiaries, which now can be created with only legislative notification and within certain limits.

- MTA capital spending reached record levels in 2019, hitting $7.3B.

- Unfortunately, in 2020, MTA capital spending dipped to $4.5B in the first three quarters due to COVID-19 disruptions (January through end of September).

- Only 46% of the 2015-2019 capital plan funds had been spent as of the end of September 2020, meaning that more than half of the plan was unfinished. Capital spending capacity is still of concern as the MTA seeks to complete prior capital plans and the massive 2020-2024 plan.

- The Legislature should pass MTA transparency legislation to shine a better light on MTA operations and capital projects, and consider other legislative measures to improve transparency like requiring publication of a contracts database. Two bills we urge the Legislature to pass in 2021 are:

-

- S4625/A1142 – Senator Comrie’s MTA Open Data Act (Assemblymember Carroll sponsors in Assembly).

- S2768/A791 – Senator Ramos’s MTA Capital Dashboard and Financial/Budget Transparency Legislation (Assemblymember Carroll sponsors in Assembly).

Legislature Must Ask for Full Data on East Side Access Operating Costs

Now turning to East Side Access specifically, we urge the Legislature to ask the MTA for full data for projected ridership and operating costs, including the MTA’s service plan(s) for East Side Access and Penn Access. This information will allow the Legislature to understand the return on investment for the project and intended service levels for your constituents, including new capacity for commuter service, reverse commuting, and trips made only within NYC.

It is telling that in the MTA’s August 2020 “Doomsday” plan, one of the options put on the table to cut costs was delaying revenue service for East Side Access. The MTA’s plan stated that $250M could be saved in operating costs if revenue service was delayed beyond December 2022, the current expected start date.

Similarly, the State Comptroller’s September 2019 report on the MTA’s finances found that the East Side Access project was a factor contributing to the MTA’s structural imbalance in its budget. The report said that the cost of operations and maintenance for ESA were projected to reach $205M by 2023, but fare revenue would only increase by $14M in 2023 – a $191M deficit. While this analysis was done pre-COVID, the current depressed ridership indicates that costs will be even more difficult to recoup as ridership is slow to rebound to 2019 levels.

Consideration of Expanding NYC Trips in Commuter Railroads

The MTA and the Legislature should also look at ways to increase ridership on Long Island Rail Road and Metro North Railroad within the city and through reverse commuting to help generate additional revenue and take advantage of the increased capacity, such as through Freedom Ticket or Atlantic Ticket-type expansions that have been proposed by transit advocates.Pre-Covid, the Legislature considered 10-20% discounts on LIRR and MNR travel within NYC as part of its Outer Borough Transportation Fund projects. We understand that the fund did not collect sufficient funds last year to be distributed, but expect it to have sufficient funds soon. Rather than providing discounts for passenger vehicles while the region as a whole is addressing climate change with congestion pricing and other measures, transit advocates have suggested using the funding for increased bus service or providing discounted trips within NYC on the commuter rails, which could create incentives for using the new ESA capacity. (As a side note, the Legislature should release to the public its final Outer Borough Transportation Fund projects list, if available, as requested by 18 groups in August 2019, which we understand must be approved by the Capital Program Review Board.)

Concerns about Creation of a New Subsidiary for ESA Maintenance

The MTA has issued an RFP to outsource operation and maintenance of the new East Midtown Terminal located within Grand Central. The responsibilities of the new service provider goes beyond maintaining the concourses, mezzanines and platforms to include maintenance of tracks, signals and communication, and vent plants.

The RFP also states that the MTA intends “create a new subsidiary agency that will be responsible for the oversight and contract management of the service provider during the term of the contract and the contract will be awarded by MTA C&D in the name of this new agency.” Creation of subsidiaries under New York State Public Authorities Law requires notification to the Legislature and the Authorities Budget Office.

The MTA already has a vast bureaucracy, and this new subsidiary coupled with outsourcing a non-MTA workforce would add operational complexity to the management of the new terminal. Additionally, it will be harder for the public to assess labor costs with the use of a third-party service provider, and assess overall operating costs for ESA if it is split between agencies and subsidiaries.

While LIRR, MNR, and MTA Construction & Development will retain some responsibilities, it is unclear how this new subsidiary will fit into the MTA’s existing governance structure and who within MTA will actually own responsibility for the new terminal. At a time when the MTA is seeking to centralize its operations with its reorganization plan, the creation of a new subsidiary is completely counter to that goal.

Additionally, we are concerned that creation of a subsidiary to handle ESA maintenance would shift substantial maintenance costs off the books of LIRR, and add opacity to the MTA’s budgeting.

Given these concerns, we ask the Legislature to ensure that the MTA provides the public and Legislature with a detailed rationale for creation of the subsidiary.

Legislature should be concerned generally about the creation of new public authority subsidiaries given their proliferation in New York State and the limited capacity of oversight bodies. In total, there are more than 1,000 public authorities and subsidiaries which have issued 96% of outstanding state-support debt, with 585 authorities subject to Authorities Budget Office oversight. The ABO has only a staff of 11 and a budget of $2M to do the herculean task of overseeing all of these bodies.

To this end, we recommend that the Legislature pass S5137 (Mattera)/A4078 (Colton), which would require legislative approval of the creation of new public authority subsidiaries. This would put state law in better alignment with the State Constitution, which envisioned legislative approval for the creation of public authorities. The legislation has already moved through committee in the Senate, and is on third reading.

MTA Capital Spending Increased to Record Levels in 2019, But Gains Set Back by COVID-19 in 2020

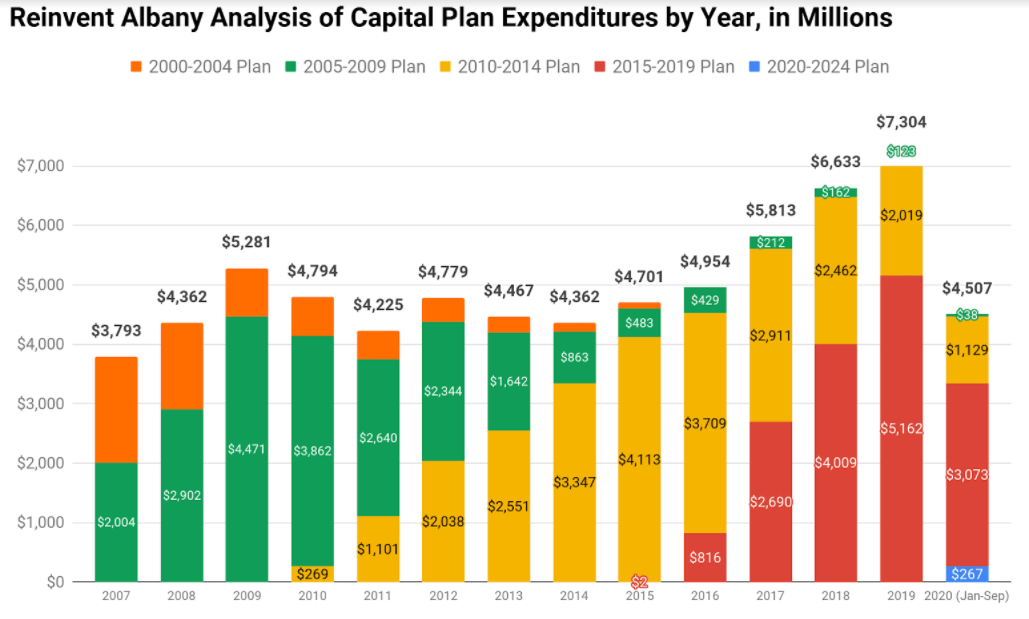

At your November 2019 oversight hearing on the MTA’s 2020-2024 capital program, Reinvent Albany provided you with an analysis of the pace of MTA capital spending since 2007. Our analysis used capital expenditures as a gauge of progress rather than commitments, because a commitment is just one of the first steps on the way to completion. Spending is also a good gauge of activity because it shows the progress in making payments to contractors. Under prompt payment rules, MTA contractors are paid within 30 days upon completion of work or tasks. Below is an updated chart of the MTA’s capital spending as of end of September 2020 (full year data is not yet available).

Our research of MTA consolidated financial statements shows that in 2019 the MTA picked up the pace and spent a record $7.3B total on capital projects. However, this was not enough to fully clear the backlog of old capital projects. For example, the MTA spent more than $2B on 2010-2014 capital plan projects in 2019, five years after the nominal end of the plan.

Looking at 2020, MTA capital spending was lower than planned, but surprisingly high considering the impact of COVID: $4.5B total was spent on capital projects through the end of September 2020 (see Interim Financial Statements for Jan – Sept 2020). COVID affected the workforces of both the MTA and its contractors, and presented massive financial challenges. For example, the FY 2020-2021 state budget authorized the use of the capital lockbox for operating costs, and a total of $440M was used in 2020 according to the MTA February 2021 financial plan. While MTA Chief Financial Officer Bob Foran stated at the March 17, 2021 Board meeting that the MTA does not intend to use capital lockbox funds in 2021 due to the receipt of federal funding, unfortunately, as of that time the MTA does not intend to pay back the lockbox funds.

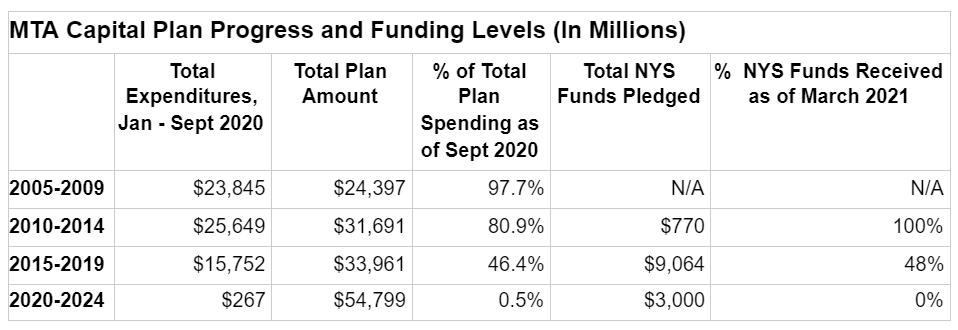

The MTA’s 2020 capital spending largely included work on past capital plans, with $38M spent on projects from 2005-2009, $1.1B from 2010-2014, $3B from 2015-2019 projects, and $267M on 2020-2024 projects. As of the latest data available, 46% of the 2015-2019 plan funds, 81% of 2010-2014 funds, and nearly 98% of funds for the 2005-2009 plan have been spent.

While we do not yet have complete data for 2020, it appears that COVID-19 will have significantly impacted the pace of MTA capital spending in 2020 despite acceleration of certain projects and better performance in 2019.

The percentage of spending left on active MTA capital plans, and level of NYS funds received as of March 2021 is below – note that NYS pledged more than $9B for the 2015-2019 plan, and 48% has been delivered to the MTA. NYS in 2020 decided to issue bonds for the MTA to pay for its contribution, rather than pay for debt service payments from bonds that the MTA issues, which would require continued state support over a thirty-year period.

COVID-19 wreaked financial havoc on the MTA in 2020, and the agency instituted several “pauses” on new capital work. This meant that work progressed on prior plan projects, but only $267M was spent on the 2020-2024 capital plan in the first three quarters of 2020. At the same time, however, the Governor and MTA stated that they were taking advantage of depressed ridership to accelerate certain capital projects like the F train’s Rutgers Tube and making 11 more stations ADA compliant.

It is also worth noting the findings of a recent report from Comptroller Tom DiNapoli regarding the MTA’s debt burden as concerns the 2020-2024 capital plan. The report found that since the MTA borrowed $2.9B for operating from the Federal Reserve’s Municipal Liquidity Facility, it no longer can afford its planned $9.8B contribution to the 2020-2024 capital program. Further, the report found that the MTA is faced with the choice of cutting $2.9B from the plan or issuing more unaffordable debt.

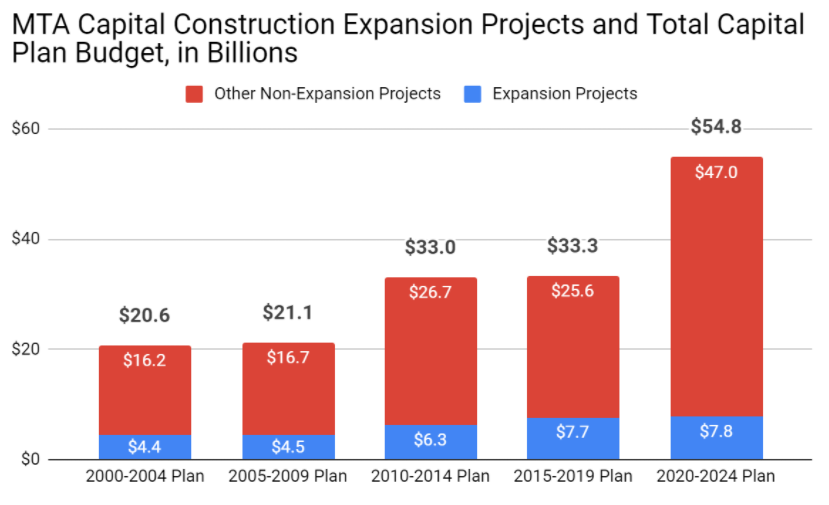

The MTA’s pace of capital spending is worth closely monitoring as the Legislature thinks about lessons learned from East Side Access and other mega projects, particularly as their total price tags are often greater than the MTA’s total annual capital spending ($11B+ for East Side Access, for example). Projects of this magnitude create opportunity costs for other capital work like signals and state of good repair, as they eat up considerable financial and personnel resources. See below the split between expansion projects and other capital work from the last several MTA capital plans. Only in the most recent $55B 2020-2024 capital plan has the scope of expansion projects slowed – for the 2015-2019 plan, expansion projects consumed 23% of the total plan with $7.7B in planned expansion spending, while the 2020-2024 plan has $7.8B in spending for expansion projects, 14% of the total plan.

Need for MTA Open Data on Capital Project Progress and Contracts

In our 2019 Open MTA report, we provide 50 recommendations about ways to increase transparency and accountability at the MTA. Eighteen of these recommendations are specific to transparency and would help increase public knowledge and ability to conduct analysis and oversight of projects like East Side Access. Three priority items include:

- Passage of Senator Comrie’s legislation to codify the Governor’s open data executive order for the MTA – S4625. This would ensure compliance by the MTA with posting its public data on an open data portal, with schedules for intended release of the MTA’s various datasets.

- Passage of Senator Ramos’s legislation to codify the MTA capital dashboard, with requirements for honest reporting of information, and open data for MTA budget and financial information – S2768.

- Creation by MTA of a contracts database as recommended by Reinvent Albany in our OpenMTA report with more complete, searchable information about projects and vendors. The Legislature could also pass legislation to require this.

Thank you for your consideration. I am available for any questions you may have.