Growing Number of Groups, Legislators Support Ending NY Tax Breaks For Real Estate Developers Investing In “Opportunity Zones”

Growing Numbers of Groups, Legislators Support Ending

New York Tax Breaks For “Opportunity Zones” – A Trump Favorite

2017 “OZ” program a windfall to wealthy real estate developers costing

NYC and NYS taxpayers hundreds of millions during COVID budget cuts

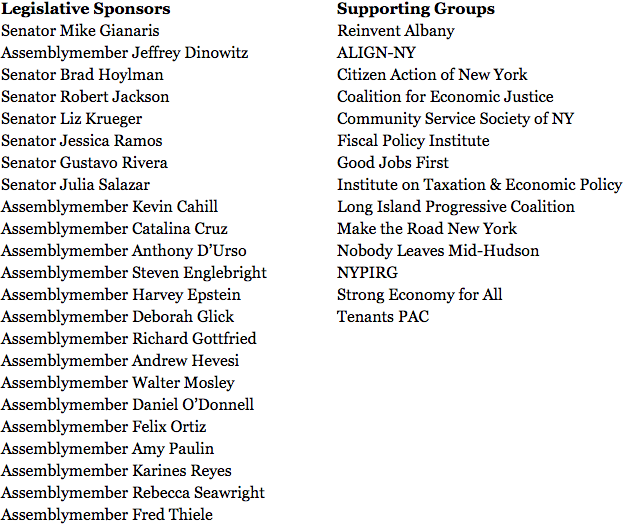

A growing number of state legislators and advocacy groups are calling for the passage of state legislation that will end hundreds of millions New York State and local tax breaks for real estate developers investing in federal Opportunity Zones.

Legislation sponsored by State Senator Michael Gianaris and Assemblymember Jeffrey Dinowitz (S3401B and A10443) “decouples” New York’s capital gains tax code from the 2017 Tax Cuts and Jobs Act.

——————————————————-

——————————————————-

Extensive coverage of Opportunity Zones in the New York Times, Wall Street Journal, and Bloomberg News has revealed the program to be a boondoggle and taxpayer giveaway to wealthy and politically connected real estate developers. Reinvent Albany details the OZ program in our Memo of Support for the Gianaris/Dinowitz legislation.

President Trump Is The Biggest Cheerleader for Opportunity Zones

My admin has done more for the Black Community than any President since Abraham Lincoln. [We] passed Opportunity Zones …

-June 2, 2020 tweet from @realDonaldTrump

Criminal justice reform: Obama couldn’t do it. I got it done … If you look at all of the Opportunity Zones — they’re inner-city Opportunity Zones, almost all of them. African American.

-July 31, 2019 remarks by President Trump After Marine One Arrival

Journalists Document What OZs Really Are

Opportunity Zones are a new federal program that developers see as one of the great tax-avoidance programs ever created in this country.

–The Real Deal, October 24, 2018

[Opportunity Zones are] a once-in-a-generation bonanza for elite investors.

-The New York Times, August 31, 2019

Conservative Policy Experts Oppose Opportunity Zones

Opportunity Zones are just the latest misconceived and ineffective federal program that fails to grasp what makes cities thrive … The belief that targeting some 7,000 lower-income census tracts with a special tax credit will propel their residents out of poverty ignores a long history of failed urban-development policies.

–City Journal, September 9, 2019

O Zones have balkanized American cities into winner and loser zones, while encouraging corruption and making the tax code more complex … O Zones are supposed to alleviate poverty, but the main beneficiaries are the landlords who own development sites within the politically chosen zones.

–CATO Institute, May 7, 2019

Targeted development programs similar to Opportunity Zones fail to help those in need. In fact, they have a history of unintended consequences and corruption.

–The Heritage Foundation, July 12, 2019

Progressives Oppose Opportunity Zones

These policies almost inevitably result in tax giveaways for investment that would have occurred anyway, as we’re beginning to see with opportunity zones. Under such circumstances, displacement from gentrification is the likely result.

–Salon, May 21, 2018

Opportunity Zones are in fact a corrupt scam to enrich Trump’s cronies. The provision, added to his 2018 tax cut, sounds appealing on the surface. It gives a capital gains tax cut to It gives a capital gains tax cut to developers who build new projects in poor urban areas. The problem is that, even conceptually, the incentive is not going to drive investment in the poorest areas.

–New York Magazine, March 5, 2020

Of all the ways President Trump’s 2017 tax cut has enriched the wealthy at the expense of the public interest, perhaps the most outrageous is the black comedy of “opportunity zones … The tax break is being used to juice the profit margins on projects like a proposed luxury condominium development at a “superyacht marina” in ritzy West Palm Beach, Fla.

–The New York Times, November 16, 2029

-30-